Summit Credit Union Mobile

Version:4.42.71

Published:2024-08-09

Introduction

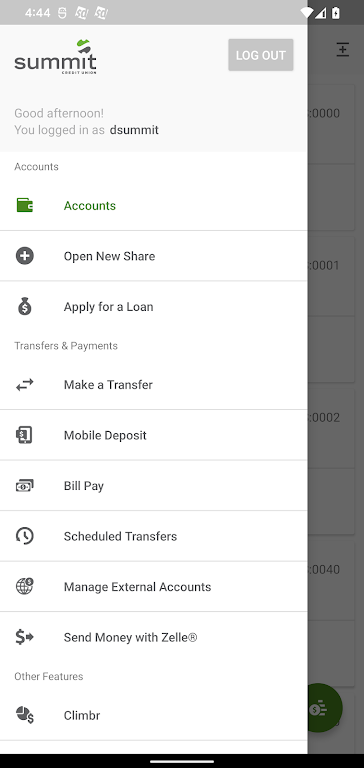

Introducing the Summit Credit Union mobile banking app, designed to make managing your money on the go a breeze! With a single login, you can easily view all of your Summit accounts and transactions, ensuring you always stay on top of your finances. The app also offers advanced security features, including multi-factor authentication and biometric login options for supported devices. Send money to your loved ones effortlessly using Zelle®, and transfer funds between your Summit and external accounts in a snap. Stay in control of your finances with personalized security and balance alerts, and track budgets and set goals with Climbr®.

Features of Summit Credit Union Mobile:

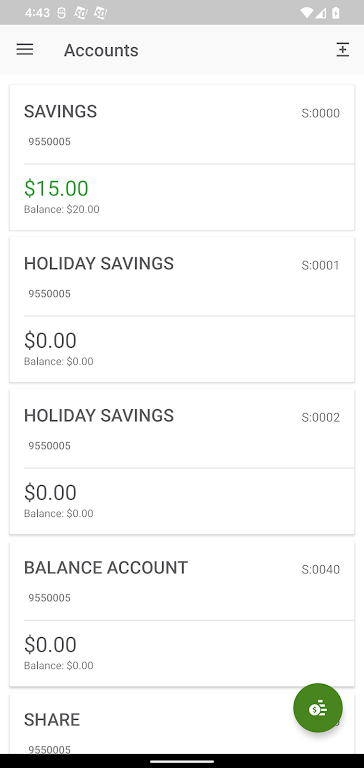

* Comprehensive Account Management:

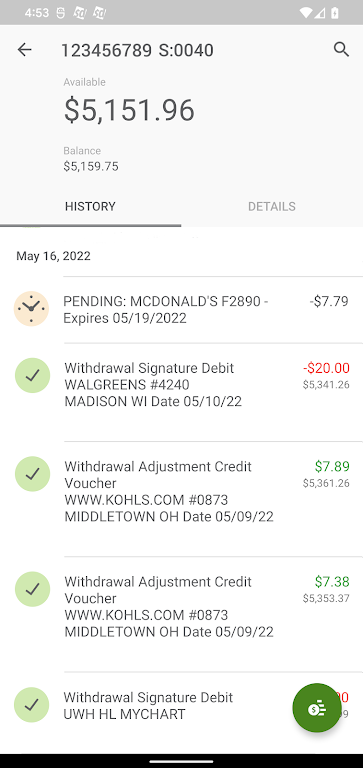

With a single login, you can seamlessly view all your Summit accounts and transactions. This feature eliminates the hassle of switching between different platforms, allowing you to keep track of your finances effortlessly.

* Enhanced Security Features:

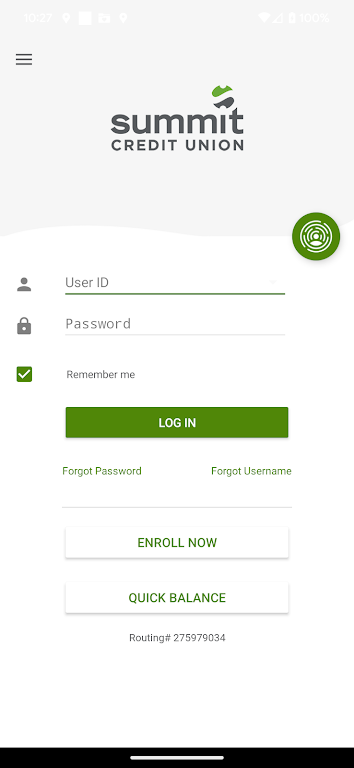

Summit Credit Union Mobile puts your financial well-being first. Enjoy advanced security features such as multi-factor authentication on every login. Additionally, supported devices offer biometric login options, including face and fingerprint ID for added peace of mind.

* Customized Banking Experience:

Tailored to suit your preferences, this app lets you create a unique username and password. Embrace banking built around you, enhancing your overall convenience and personalization.

* Convenient Money Transfers:

Send money to family and friends with ease using Zelle®. This fast and user-friendly payment service ensures quick and secure transactions, eliminating the need for third-party apps.

* Streamlined Bill Payments:

Manage your bills on the go with Summit Credit Union Mobile's built-in Bill Pay feature. Enjoy seamless payment options that integrate smoothly with the app, simplifying your financial obligations.

Tips for Users:

* Stay Informed with Alerts:

Take advantage of the app's security and balance alerts. Set notifications for all your accounts to stay informed about any suspicious activities or reminders for upcoming bill payments.

* Utilize Climbr® for Better Budgeting:

Climbr®, a powerful budgeting tool integrated into the app, helps you track your spending and set financial goals. Leverage its features to budget efficiently, monitor your outside accounts, and receive alerts that highlight your progress.

* Access Location-Specific Services:

Discover the nearest Summit branch or ATM effortlessly through the app. Schedule appointments with customer service representatives to address specific concerns or navigate any banking requirements.

Conclusion:

Summit Credit Union Mobile offers a comprehensive and convenient mobile banking experience. From simplified account management to enhanced security measures and efficient payment options, this app caters to all your financial needs. Take advantage of the advanced features, including Climbr® budgeting tools and alerts, to streamline and optimize your money management. Download the Summit Credit Union Mobile app today and unlock the full potential of convenient and secure banking at your fingertips.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16

Comment

Elizabeth Hetrick

This has got to be one of the worst online banking apps out there. It's probably not Summit's fault- it's probably 3rd party software- but it is awful. Access and logins are given solely to the primary account holder, even on joint accounts, business accounts cannot be accessed without another, different login. Secondary acct holders can't deposit into joint accounts. I could go on, but let's just say that this system is only set up for individual, non-entrepreneurial, account holders.

Aug 13, 2024 10:32:23

Forehand

Opened up an account just so I could have a local branch when needed. Charges $5 fees every month and a yearly debit card fee until my account is empty then closes the account. The debit card they sent wouldn't even activate. So basically stole my deposit and they made money lending it out on top of the fees. Alliant credit union doesn't charge me anything and pays me interest.

Aug 13, 2024 06:40:15

A Google user

The functionality of this app is good for the most part. Easy to log into and transfer funds quickly. One issue I've ran into is that the website does not let you change your password and your user ID in the same day. I was locked out of my account for hours due to this. They should put notice of that somewhere so people know ahead of time.

Aug 13, 2024 01:30:08

Brogurt T-Bone

Great for a while, then suddenly stopped working. Error loading presets, waited a week, error stayed, uninstalled and reinstalled, error still there. Edit: after a while, the present error disappeared, but upon login it turned off my account. After a while again, it started working fine and I am left with no explanation for what happened or why (no email or anything similar). I feel this is unacceptable and will keep my rating low.

Aug 11, 2024 20:51:57

Josiah Zanghi

Overall solid app, but two big flaws are that you can't view mortgage payment history or tax documents through it

Aug 11, 2024 20:48:41

Robert Gransee

The app still functions as well as it always has, at least in my experience, but the all-white interface is way too bright & harsh. At present the app does not work with my phone's (Note20 Ultra) dark mode. Please bring back the former green color scheme or incorporate a dark mode into the app settings.

Aug 11, 2024 17:29:03