MoneyTap - Credit Cards & Loan

Version:4.6.1

Published:2024-08-10

Introduction

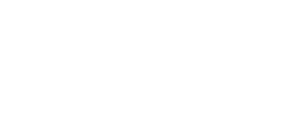

MoneyTap - Credit Cards & Loan is a revolutionary app that provides instant approval for credit up to ₹5,00,000, with the added benefit of paying interest only on the amount you withdraw from your balance. Gone are the days of worrying about high interest rates and complex loan terms. With it, salaried employees can enjoy the flexibility of using credit as an early salary. This fully digital and paperless app offers a seamless experience, allowing you to borrow any amount starting at ₹3,000 and repay it with flexible EMIs. Say goodbye to complicated loan applications and say hello to it, the best instant personal loan app in India.

Features of MoneyTap - Credit Cards & Loan:

Flexible Borrowing: It allows users to borrow any amount starting at ₹3,000 from their approved Credit Limit. This gives users the freedom to choose an amount that suits their needs, whether it is for a small expense or a larger investment.

Pay-as-you-use Interest: One of the key features of it is that users only pay interest on the amount they actually use.

Instant Approval: It offers instant approval for credit up to ₹5,00,000 lakhs. This means that users can get access to funds quickly, without the need for lengthy approval processes or paperwork.

Fully Digital Experience: It provides a fully digital and paperless experience. Users can apply for a personal loan, submit their documents, and track their loan status all through the app. This eliminates the hassle of visiting physical branches and waiting in long queues.

FAQs:

How long can I repay the loan?

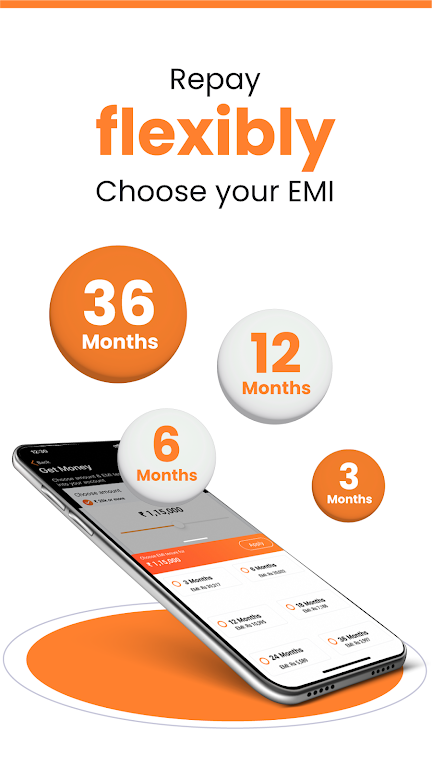

It offers EMI tenures ranging from 3 to 36 months. Users can select a repayment period that suits their financial situation and preferences.

What are the fees associated with a personal loan from it?

It charges low processing fees ranging from 0% to 7% and a one-time setup fee depending on the loan amount.

What documents are required to apply for a personal loan from it?

To apply for a personal loan, users need to provide their Aadhaar number, identity proof, address proof, a passport-sized photo/selfie, and other relevant documents as specified by it.

Conclusion:

MoneyTap - Credit Cards & Loan stands out as the best instant personal loan app in India for several reasons. The flexibility it offers in borrowing any amount starting at ₹ 000 up to ₹5 lakhs, coupled with the pay-as-you-use interest feature, provides users with greater control over their finances. The instant approval process and fully digital experience make it convenient and hassle-free for users to access funds. With competitive interest rates, low fees, and customizable EMI tenures, it ensures that users can borrow money on terms that suit their needs. Experience the convenience and flexibility of it for all your personal loan needs.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16

Comment

Sorabh Shrivastava

This app is fake everytime this app checking credit report and stuck not provide any offer and keep masseging applied loan what a froud app don't trust this app

Aug 15, 2024 06:01:25

Ankit Sanyal

Basically they are not providing loan but advising you from which app you can take loan

Aug 14, 2024 22:04:06

RANGANATHA KV

Most worst app , I have submitted all the necessary documents for ENach, till today it was not happenned and no Customer care support .worst worsen and worstest

Aug 14, 2024 20:36:18

lizzy rajan

Time to remove from playstore . Fake promises, scam phishing message, creditline not working.

Aug 14, 2024 18:36:58

Kunal Nitin

It's good for those who are need in urgent money. Just improvement required to increase in the limit of loan.

Aug 14, 2024 05:37:16

Abdul D.

Worst experience.taken all documents and not provided loan.simply fake app I think so.

Aug 13, 2024 15:33:46