TachyLoans - Instant Loan for Education

Version:1.62

Published:2024-08-12

Introduction

Looking for quick and hassle-free financing options for your education expenses? Look no further than TachyLoans - Instant Loan for Education - the leading education loan provider in India. With partnerships with top banks and NBFCs, TachyLoans offers instant collateral-free loans with interest rates starting at just 11.50%. What makes TachyLoans stand out is their complete digital experience - from application to disbursement, all without the need to step out of your home. With simpler processes, faster approvals, and smarter borrowing options, TachyLoans is the go-to choice for students and professionals alike.

Features of TachyLoans - Instant Loan for Education:

⭐ Fast and Convenient Loan Process:

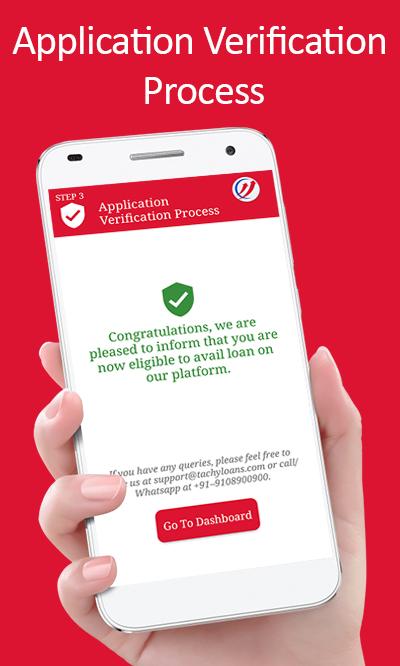

It provides a complete digital experience, from the application process to loan disbursement. You can easily apply for a loan from the comfort of your home without the need to visit a physical branch. The streamlined process ensures faster approvals, making it a smarter way to borrow.

⭐ Flexible EMI Tenures:

With TachyLoans, you can choose a repayment plan that suits your financial capabilities. The app offers flexible EMI tenures ranging from 6 to 36 months, allowing you to repay the loan according to your convenience.

⭐ Loan Amounts to Cater Various Needs:

Whether you need to finance school or college fees, professional certification, or skill development, TachyLoans has you covered. The app provides loan amounts, ensuring that you can meet your educational expenses without any hassle.

⭐ Collateral-Free Loans:

It offers collateral-free loans, removing the need for any security or guarantees. This feature makes it easier for individuals to access the funds they require for their education without having to provide valuable assets as collateral.

Tips for Users:

⭐ Check Eligibility Criteria:

Before applying for a loan, make sure you meet the eligibility criteria set by TachyLoans. Also, ensure that your salary is credited to a bank account.

⭐ Gather Required Documents:

To complete the loan application process, you will need to provide certain documents, including PAN, current address proof, selfie, last 6 months' bank statement, and last 3 months' payslips. Make sure to gather these documents beforehand to expedite the loan approval process.

⭐ Understand Fees and Charges:

It charges a processing fee of 2% of the loan amount, subject to applicable GST. It's important to be aware of these fees and charges to accurately assess the cost of borrowing. Take the time to read and understand the terms and conditions associated with the loan.

Conclusion:

TachyLoans - Instant Loan for Education is a highly convenient and user-friendly app for individuals seeking financial assistance for their educational pursuits. With its seamless digital experience, flexible repayment options, and collateral-free loans, TachyLoans provides a solution that simplifies the loan application and approval process. By ensuring data security and complying with privacy standards, TachyLoans prioritizes the protection of user information. Download the TachyLoans app now and embark on your educational journey with ease.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16