Get Loan on Aadhar Card Guide

Version:1.0.6

Published:2024-08-12

Introduction

Introducing the Get Loan on Aadhar Card Guide! This mobile guide provides all the information you need to know about getting loans online with minimal documentation. Whether you're looking for a personal loan, home loan, education loan, credit card loan, business loan, gold loan, or car loan, this app has got you covered. With loan amounts ranging from ₹2,000 to ₹1,00,000 and flexible loan periods from 91 to 180 days, you have the freedom to choose what works best for you. Plus, with low interest rates and a simple application process, getting a loan has never been easier. So why wait? Download the Loan Guide App now and take control of your financial future!

Features of Get Loan on Aadhar Card Guide:

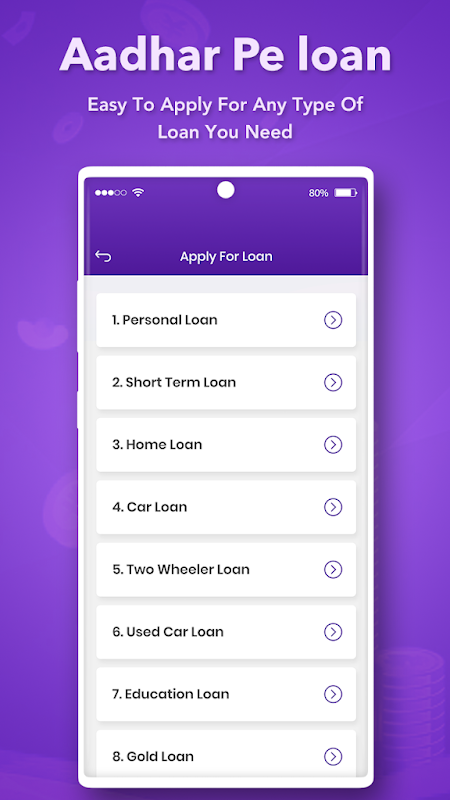

- Comprehensive information: The App provides detailed information on various types of loans, including personal loans, home loans, education loans, credit card loans, business loans, gold loans, and car loans, making it a one-stop solution for all your loan needs.

- Loan amounts and duration: The app offers personal loans ranging from ₹2,000 to ₹1,00,000 with loan durations between 91 and 180 days. This flexibility allows users to choose the loan amount and duration that best suits their needs.

- Transparent interest rates: Users can easily calculate the interest payable on their loan using the app's built-in calculator. With a simple formula, the app ensures complete transparency by showing users the exact interest they would be paying.

- Low interest rates and processing fees: The Loan Guide App offers loans with average monthly interest rates between 2% - 3%. Additionally, the app charges a processing fee ranging from 5% to 15% of the loan amount. These low rates ensure that users can avail loans without any financial burden.

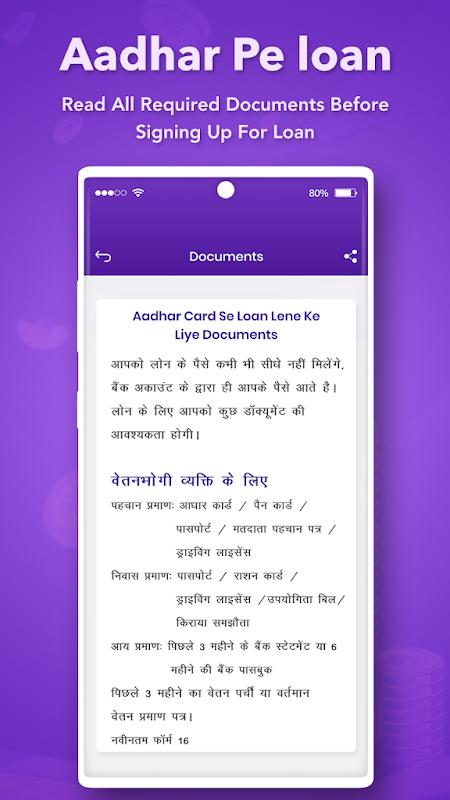

- Easy application process: The app simplifies the loan application process by eliminating the need for extensive paperwork. Users can easily fill in their basic information, submit the application, and await the verification process. The entire application process can be done from the comfort of your own home, eliminating the need to visit a physical location.

- Eligibility criteria: To be eligible for a loan through the app, users need to be Indian citizens between 18-45 years old and have a stable source of monthly income. These minimal requirements make the app accessible to a wide range of users.

Conclusion:

The Get Loan on Aadhar Card Guide provides a user-friendly and convenient solution for obtaining loans online with minimum documentation. With its comprehensive information on various loan types, flexible loan amounts and durations, transparent interest rates and fees, user-friendly application process, and minimal eligibility criteria, this app is the perfect companion for anyone in need of financial assistance. Download the app now and take the first step towards fulfilling your financial goals.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16