JEDA LOANS (जेड़ा लोन )

Version:1.5

Published:2024-08-12

Introduction

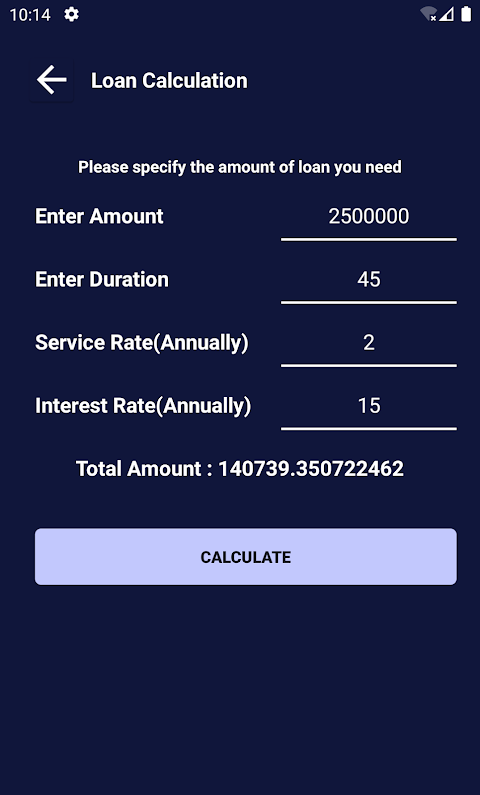

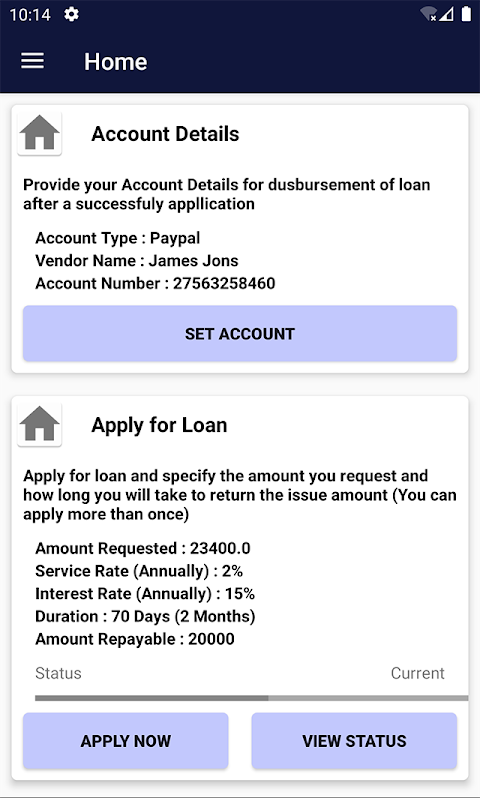

Introducing JEDA LOANS, the ultimate solution to your financial emergencies. With just a few simple steps, you can apply for a loan and get the money you need within minutes. Our platform offers loans of up to Ksh 70000 at low interest rates, ensuring that you can overcome any unexpected situation without breaking the bank. The best part? The entire process is done online, allowing you to borrow funds conveniently from anywhere, anytime. Say goodbye to paperwork and guarantors! Our focus is on your financial transfer history, rather than credit scores, making the qualification process easier than ever. Experience instant and quick loans with it today!

Features of JEDA LOANS:

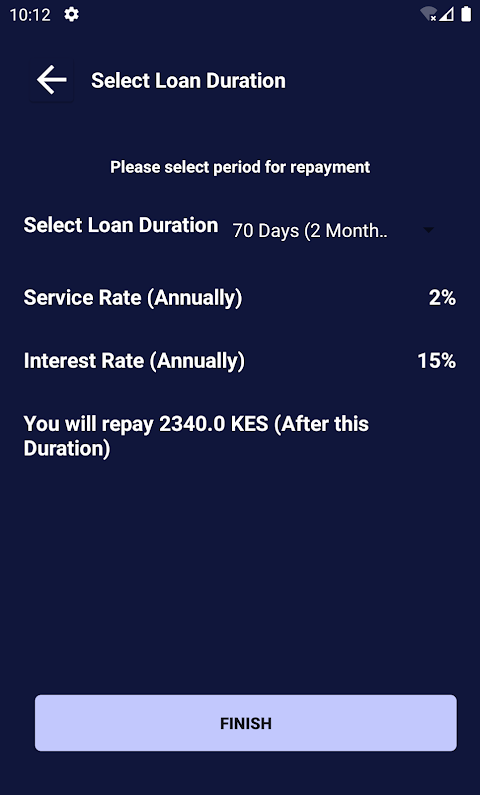

Easy and Convenient Application Process: JEDA LOANS offers a hassle-free and user-friendly loan application process. With just a few simple steps, you can apply for a loan and get the money within minutes. No need for complicated paperwork or lengthy verification processes.

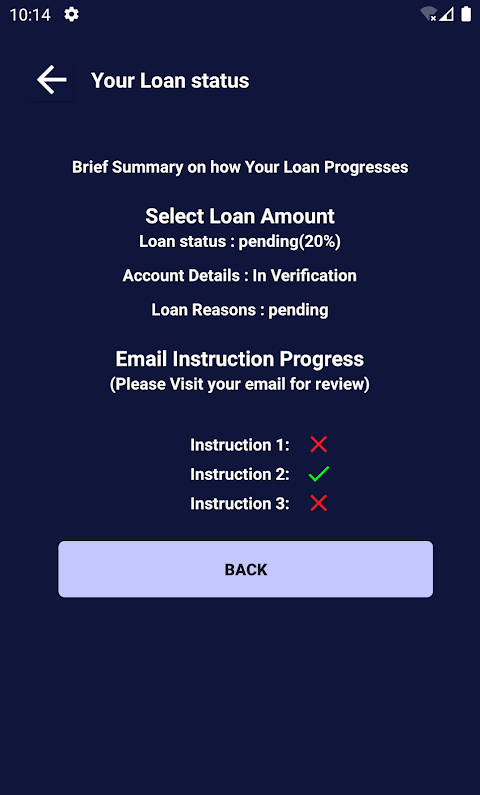

Quick and Instant Approval: Unlike traditional loans that may take days or weeks for approval, it provides instant and quick loan approvals. You can receive the loan amount in a matter of minutes, making it perfect for emergency situations.

Low Interest Rates: JEDA LOANS offers competitive interest rates in the market. You can avail loans of up to Ksh 70,000 at affordable interest rates, ensuring that you don't burden yourself with high repayment amounts.

No Credit Score Required: Unlike other types of loans that heavily rely on credit scores, it focuses on your financial transfer history on your mobile phone. As long as you have a dependable means to repay the loan, you can easily qualify for a loan without the need for a high credit score.

Secure and Trustworthy: JEDA LOANS guarantees the security and privacy of your personal information. They use encryption techniques to protect your data and promise never to share your information with third parties. You can trust that your privacy is taken seriously.

FAQs:

Do I need to provide any collateral or guarantor to get a loan from it?

No, it does not require any collateral or guarantor to approve your loan. The loan process is solely based on your financial transfer history and repayment capability.

How long does it take to get the loan approved and receive the money?

It prides itself on providing instant approvals. Once you complete the loan application process, you can expect to receive the money within minutes.

Can I apply for a loan at any time of the day or night?

Yes, it is an online platform that allows you to apply for a loan at your own convenience, 24/7. You don't need to visit any physical location or adhere to specific business hours.

Conclusion:

JEDA LOANS offers a convenient and secure platform for quick and instant loans. With an easy application process and no credit score requirement, it has become a preferred choice for individuals facing emergency situations. The low interest rates and hassle-free approval make it an attractive option. Additionally, the privacy and security measures taken by it ensure that your personal information remains safe. Choose it for a reliable and efficient lending experience.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16