CreditFit

Version:4.2.0

Published:2024-08-13

Introduction

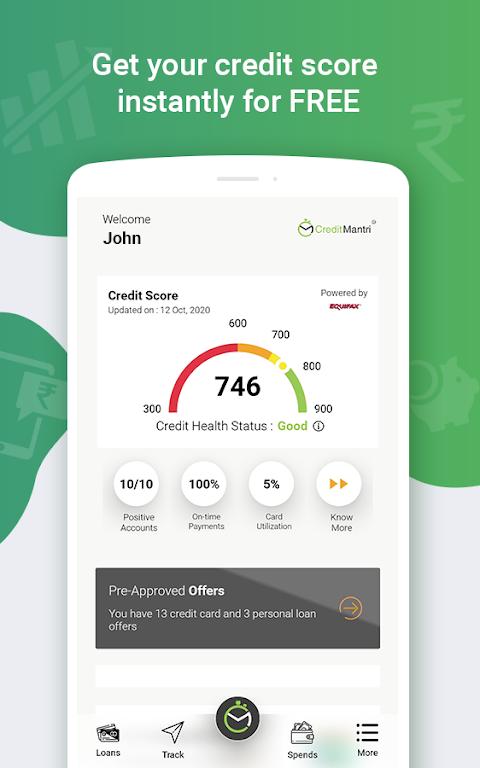

Introducing CreditFit, the app that helps you take control of your credit health. With it, you can easily check your free credit score and get a detailed analysis of your credit profile. Worried about improving your score? it has got you covered with personalized recommendations from credit experts. But that's not all! This app also helps you track your spends and bills, plan your budget, and even reminds you of your EMIs and credit card bills. Need a loan or a credit card? it offers exclusive offers from top banks and lenders, with instant approval. So why wait? Download it now and start your journey towards a better credit future!

Features of CreditFit:

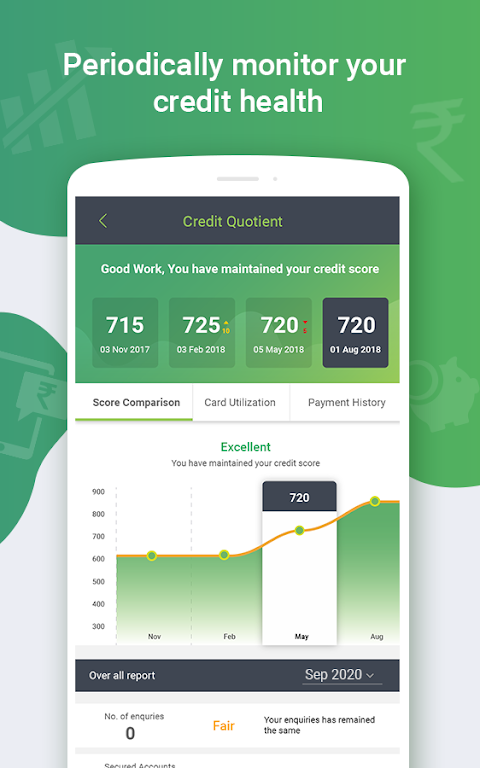

> Check Your Credit Score: With it, you can easily check your credit score for free. This gives you a clear understanding of your credit health and allows you to track your progress over time.

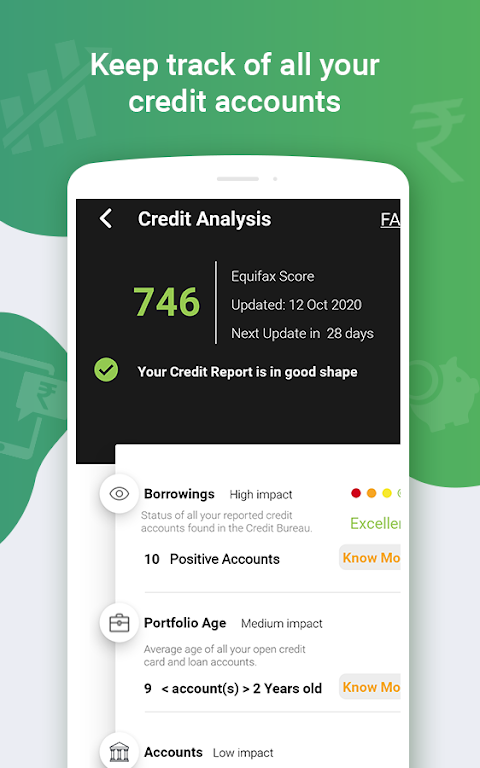

> Detailed Credit Profile Analysis: Once you've checked your credit score, it provides a detailed analysis of your credit profile. This analysis helps you understand the factors that impact your credit score and provides personalized recommendations to help you improve it.

> Track Your Spends and Bills: It offers a budget planning tool that allows you to track your expenses across various categories. You can quickly add any cash spent to accurately track your expenses. Additionally, you receive EMI and credit card bill reminders to ensure you pay on time.

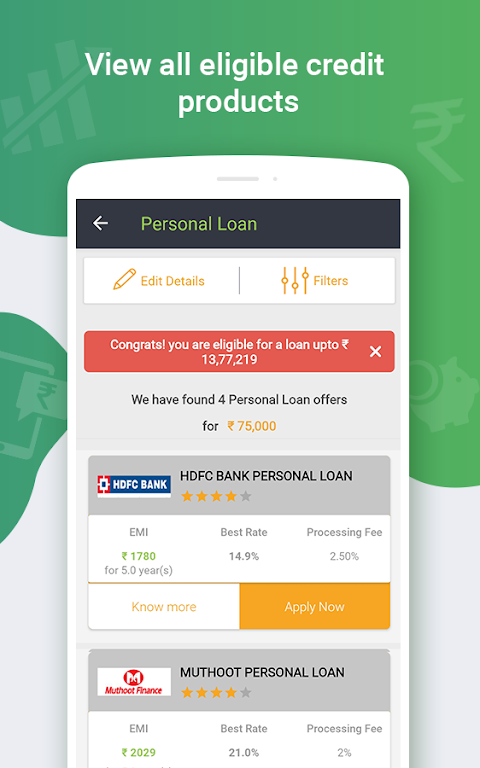

> Exclusive Loans and Credit Card Offers: It provides access to a wide range of exclusive loans and credit cards from top banks and financial institutions. You can apply for these products and get instant approval, helping you build your credit score.

FAQs:

> What is a Credit Score and How is it Calculated? A credit score is an indicator of a borrower's ability to make credit payments on time. It is calculated based on data provided by banks and NBFCs to credit bureaus. Factors such as timely credit payments, outstanding balance, and new credit inquiries influence credit score calculations.

> Will Checking My Credit Score Hurt My Credit Report? No, checking your credit score through it is considered a soft inquiry and does not impact your credit report. It is different from a hard inquiry, which occurs when a lender requests your credit score during a loan decision.

> How Can I Improve My Credit Score and Become Loan Eligible? If you have a low credit score, it may be due to negative accounts or delayed payments in your credit report. It can help you identify these issues and provide guidance to improve your credit health.

> What Types of Loans are Available? Its marketplace offers a wide range of loans, including personal loans, home loans, auto loans, gold loans, loans against property, business loans, education loans, and two-wheeler loans. The specific loan amount, tenure, and interest rate depend on your credit profile and requirements.

> Who are the Lenders Partnered with it for Personal Loans? It has partnered with leading banks, including Yes Bank Limited, InCred Financial Services Limited, and Shriram Finance Limited, to provide personal loans.

Conclusion:

CreditFit allows you to check your credit score, track your expenses, and access exclusive loan and credit card offers. With a detailed credit profile analysis and personalized recommendations, it helps you improve your credit health. Checking your credit score through it is a soft inquiry and will not affect your credit report. The app offers a wide range of loans, and the specific loan amount, tenure, and interest rate depend on your credit profile. Partnered with trusted lenders, it ensures a seamless loan application process. Take control of your credit health and financial well-being with it today.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16