udaanCapital Credit & Cashflow

Version:3.1.2

Published:2024-08-13

Introduction

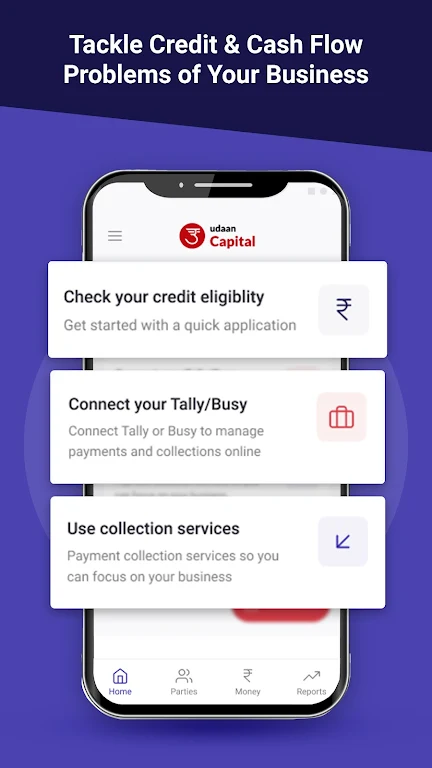

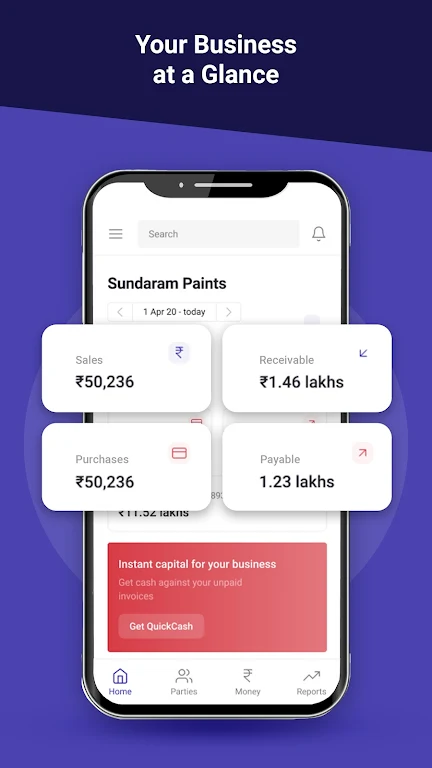

Introducing udaanCapital Credit & Cashflow, the app that revolutionizes credit and collection management for small and medium businesses. With a technology-first approach, udaanCapital provides innovative solutions to help businesses grow and succeed. One of the app's standout features is its virtual collections manager, which works tirelessly to track sales and collections, preparing a list of customers in need of payment reminders. It even sends automated reminders or alerts for uncollected dues, allowing business owners to focus on sales while udaanCapital takes care of collections.

Features of udaanCapital Credit & Cashflow:

- Innovative Solutions for Small & Medium Businesses: It offers innovative solutions to tackle credit and collection management issues faced by small and medium businesses. Through their technology-first approach, they help businesses grow their sales with purchase financing and expand their supply-side with receivables financing.

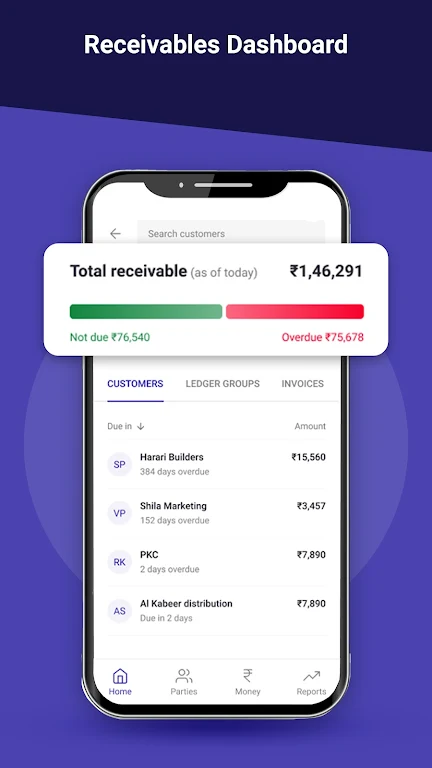

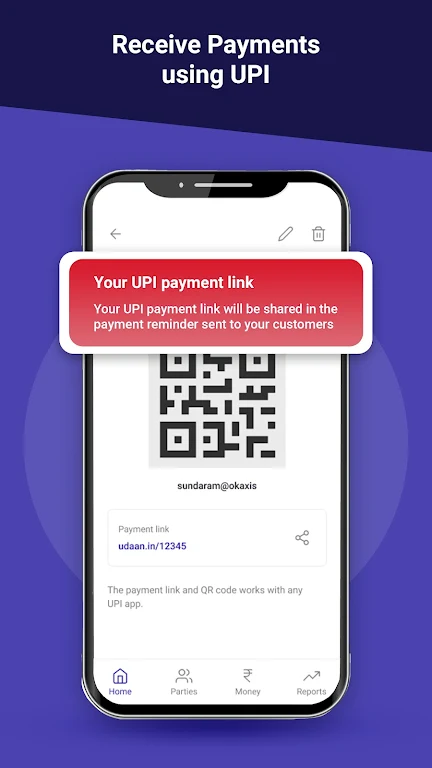

- Faster Collections: The app acts as a virtual collections manager for businesses, working 24x7 to track sales and collections. It provides automated reminders to customers who need to make payments or alerts the business for uncollected dues. This allows businesses to focus on growing sales while udaanCapital handles collections.

- CreditBuy - Purchase Financing: With its feature, businesses can avail purchase financing and pay suppliers on time using credit lines. This helps businesses manage suppliers effectively and obtain cash discounts. CreditBuy offers credit limits ranging from 1 lakh to 25 lakhs, allowing businesses to improve purchasing power and scale their operations.

- QuickCash - Credit Against Sales Invoices: It feature enables businesses to convert receivables into cash by availing credit from financing partners. Suppliers/manufacturers can receive advance payment against sales invoices, reducing stress on working capital. This facility is available to businesses managing collections through udaanCapital or selling through their anchor partners.

Tips for Users:

- Stay Updated on Business Data: The app allows businesses to view their data 24x7 on their mobile devices. Stay updated on sales and collections to make informed decisions and monitor progress effectively.

- Utilize Automated Reminders: Take advantage of the app's automated reminders feature to ensure timely payments from customers. This saves time and effort spent on manual follow-ups.

- Maximize Cash Discounts: With CreditBuy, negotiate for cash discounts instead of requesting for credits. This helps build a solid reputation and improve cash flow by obtaining discounts from suppliers.

Conclusion:

udaanCapital Credit & Cashflow offers a game-changing app for small and medium businesses to tackle credit and collection management issues. With features like faster collections, purchase financing, and credit against sales invoices, businesses can streamline their operations, improve cash flow, and scale their operations. The app's user-friendly interface and integration with accounting systems like Tally make it convenient and seamless to manage business finances. Download the udaanCapital app today and unlock the potential for growth and success.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16