PM SVANidhi

Version:1.0.10

Published:2024-08-15

Introduction

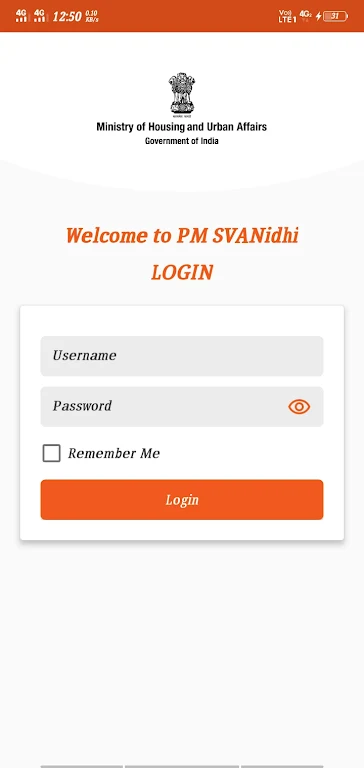

The PM SVANidhi mobile app is a complete solution for lending institutions to facilitate the loan application process for street vendors. Launched by MoHUA on June 1, 2020, this app aims to support approximately 50 lakh street vendors by providing collateral-free working capital loans of up to ₹10,000 with a tenure of one year. To encourage timely repayment and digital transactions, the scheme offers incentives such as 7% per annum interest subsidy and cashbacks of up to ₹100 per month. For the first time, NBFCs and MFIs are also included as lending institutions, and a graded guarantee cover is provided through CGTMSE. The scheme is in effect until March 2022 and more details can be found on the app.

Features of PM SVANidhi:

* Easy Loan Process: The app provides an end-to-end solution that simplifies the process of applying for a collateral-free working capital loan. With just a few clicks, street vendors can complete their loan applications and submit them through field agents.

* Financial Incentives: To encourage good repayment behavior and promote digital transactions, the PM SVANidhi scheme offers attractive incentives. Beneficiaries can enjoy an interest subsidy of 7% per annum and also receive cash-back rewards of up to ₹100 per month.

* Inclusive Lending Institutions: Unlike previous schemes, the PM SVANidhi app includes not only banks but also non-banking financial companies (NBFCs) and microfinance institutions (MFIs) as lending institutions. This expansion enables a wider reach and greater access to financial support for street vendors.

* Graded Guarantee Cover: The scheme also provides a graded guarantee cover through the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). This cover encourages lending by protecting the lending institutions against default in loan repayment on a portfolio basis.

Tips for Users:

* Stay Updated: Make sure to regularly check for updates on the PM SVANidhi app. This will ensure that you have access to the latest features and improvements.

* Complete Application Thoroughly: When filling out the loan application, be sure to provide all the necessary information accurately. This will help expedite the loan processing and approval.

* Utilize Digital Transactions: Take advantage of the cash-back rewards by conducting digital transactions wherever possible. This not only helps in getting additional benefits but also promotes financial inclusion.

Conclusion:

The PM SVANidhi provids them with easy access to collateral-free working capital loans. With its user-friendly interface and attractive incentives, the app makes the loan application process seamless and convenient. By including NBFCs and MFIs as lending institutions, the scheme maximizes its reach and ensures that street vendors from all backgrounds can benefit. The graded guarantee cover further boosts lending and gives lenders confidence in offering financial support. Download the PM SVANidhi app today and empower street vendors to resume their businesses and thrive.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16