Revfin

Version:9.1.1

Published:2024-08-16

Introduction

Introducing Revfin's innovative loan products designed specifically for electric vehicle purchases. With our Electric Three-Wheeler Loan, you can borrow a fixed sum of money for your three-wheeler and repay it in equal monthly installments over the loan term. We offer a minimum loan amount of ₹40,000 and a maximum of ₹4,50,000 or up to 90% of the vehicle's on-road price. With competitive interest rates, no pre closure charges or loan cancellation fees, this is the ideal solution for those looking to switch to an eco-friendly mode of transportation.

Features of Revfin:

FAST APPROVAL PROCESS

Our loan approval process is designed to be quick and efficient. We understand that time is of the essence when it comes to purchasing electric vehicles and ancillaries. With our fast approval process, you can expect to receive a decision on your loan application within a short period of time. This ensures that you can move forward with your purchase without delays.

FLEXIBLE LOAN TENURE

We offer flexible loan tenure options to suit your individual needs. Whether you prefer a shorter term to pay off your loan quickly or a longer term for lower monthly instalments, we have options available for you. With tenures ranging from 3 to 36 months for electric three-wheeler loans, 3 to 15 months for electric two-wheeler loans, and 3 to 24 months for EV ancillary loans, you can choose the tenure that best fits your financial situation.

NO PRE CLOSURE OR LOAN CANCELLATION CHARGES

We believe in providing transparent and fair financial services to our customers. That's why we do not charge any pre closure or loan cancellation charges. This means that if you decide to repay your loan before the end of the tenure or cancel your loan altogether, you will not incur any additional fees or penalties.

Tips for Users:

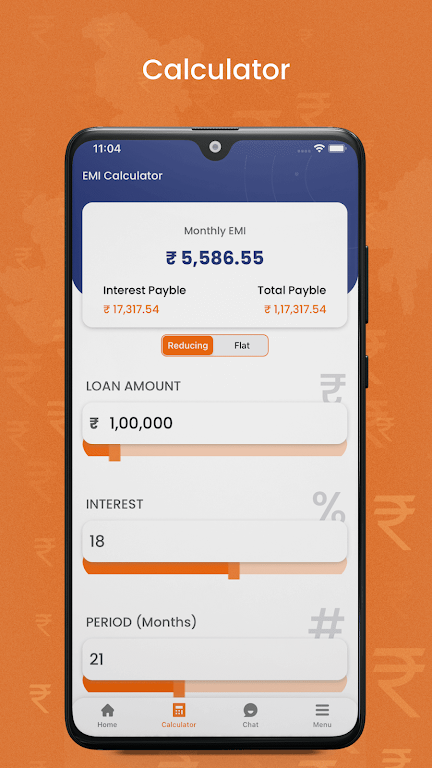

* Calculate your loan amount: Before applying for a loan, it's important to determine the amount you need. Use our loan calculator to estimate the loan amount based on the vehicle or ancillary cost and the percentage of financing available.

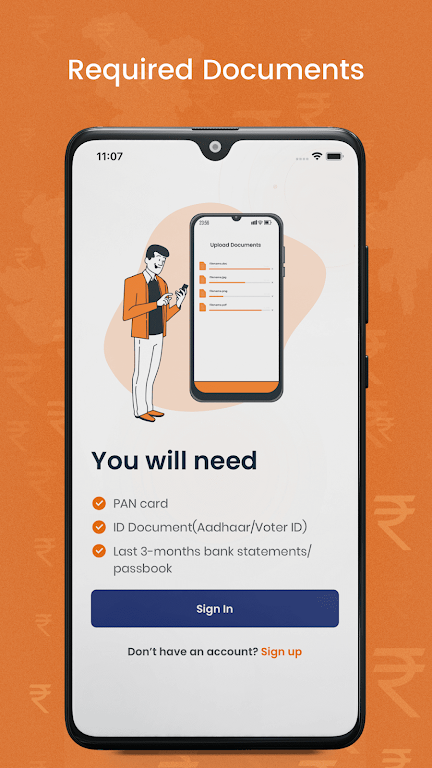

* Prepare the necessary documents: Gather all the required documents such as proof of identity, address, income, and vehicle details. Having these documents ready will speed up the loan application process.

* Compare interest rates: Take the time to compare the interest rates offered by different lenders. This will help you find the best loan terms and save money on interest payments.

Conclusion:

Revfin offers attractive electric vehicle loan options, including loans for electric three-wheelers, electric two-wheelers, and EV ancillaries. With features like flexible loan tenures, fast approval process, no pre closure or loan cancellation charges, and competitive interest rates, Revfin makes it easier for individuals to finance their electric vehicle purchases. Whether you're looking for a loan for personal or business use, Revfin provides an efficient and transparent lending experience. Apply now and embark on your journey towards cleaner and greener transportation.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16