Funding Societies

Version:3.5.5

Published:2024-08-19

Introduction

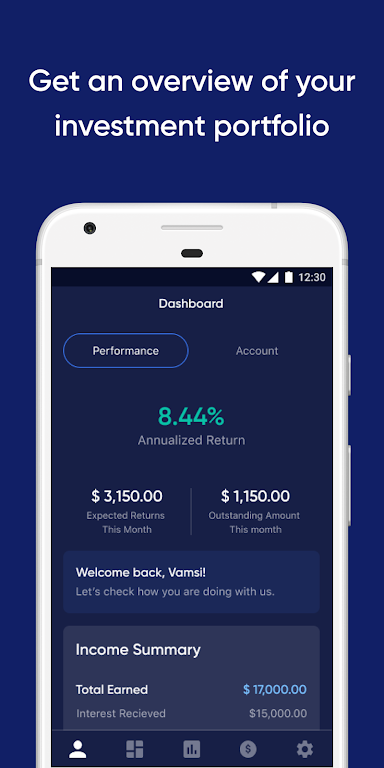

Funding Societies is the leading peer-to-peer lending platform in Southeast Asia, offering individuals and institutions the opportunity to invest in creditworthy local SMEs. With no minimum balance and a low minimum investment amount, you can easily diversify your investment portfolio by investing in various P2P investment products. Backed by prominent investors and recognized with multiple awards, Funding Societies has facilitated over S$1.83B worth of business loans since its launch in 2015. The platform offers guaranteed property-backed returns, invoice financing, dealer financing, and more.

Features of Funding Societies:

Diversify Your Investment Portfolio: Funding Societies | Modalku offers an opportunity to invest in creditworthy local SMEs, allowing you to diversify your investment portfolio and potentially earn attractive returns.

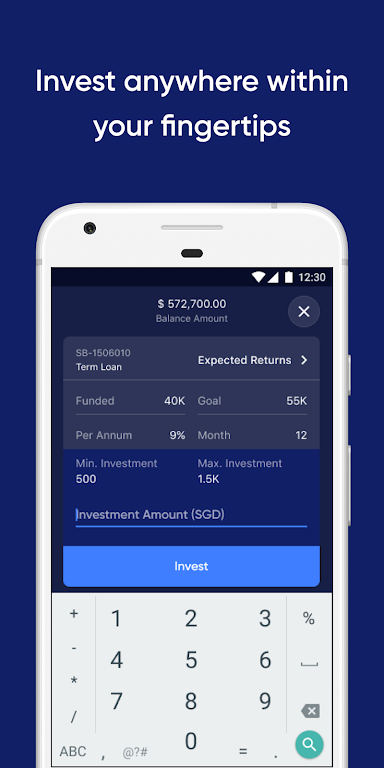

Low Investment Amount: Start investing with as little as S$20 in Singapore, RM100 in Malaysia, or S$1.83B in Indonesia. This low entry investment amount makes it accessible to a wider range of investors.

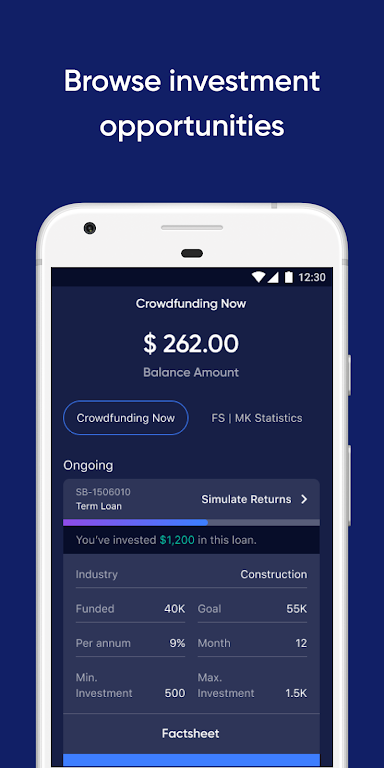

Various P2P Investment Products: Choose from a range of P2P investment products, including Guaranteed Returns, Asset-backed, Dealer Financing, and others such as Invoice Financing and Revolving Credit. This variety allows you to select the investment option that aligns with your risk appetite and investment goals.

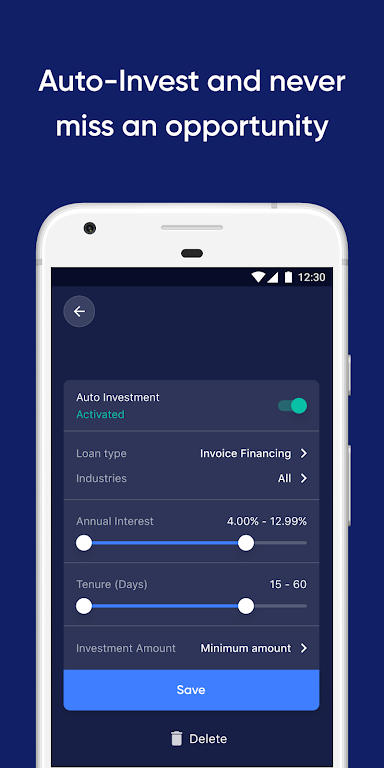

Auto Invest Feature: Set up Auto Invest or Planned Funding and let the system automatically deploy your funds based on your investment preferences. This feature enables quick reinvestment and ensures your funds are constantly working for you.

Tips for Users:

Diversify Your Investments: To mitigate risks, spread your investments across different SMEs and investment products. Diversification helps to minimize the impact of any potential defaults and increases your chances of earning consistent returns.

Understand the Risk Involved: P2P lending involves certain risks, including the possibility of default by borrowers. Before investing, make sure to read the Risk Disclosure Statement and fully understand the potential risks involved.

Take Advantage of Tax Exemption: Individual Singaporean investors can enjoy tax exemption on the interest returns from their P2P investments. This can significantly enhance your overall returns, so be sure to take advantage of this tax benefit.

Conclusion:

Funding Societies offers investors an opportunity to invest in creditworthy local SMEs and earn attractive returns. With a low minimum investment amount and various P2P investment products to choose from, investors can easily diversify their investment portfolios. The platform's Auto Invest feature ensures quick reinvestment, maximizing the potential returns on your investments. However, it's important to understand the risks involved and to diversify your investments to mitigate any potential default risks. Whether you're a seasoned investor or new to P2P lending, Funding Societies | Modalku provides a comprehensive and user-friendly platform for your investment needs.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16