Simulador Empréstimo Bancário

Version:1.0.8

Published:2024-08-21

Introduction

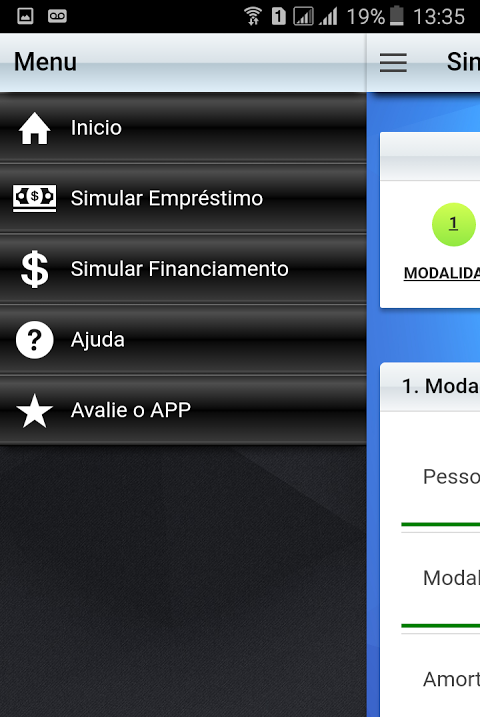

Simulador Empréstimo Bancário is the ultimate tool to help you navigate the complex world of credit operations in Brazil. Whether you are looking to negotiate a new credit contract, or considering portability or financing options, this app has got you covered. With CredSimulator, you can easily calculate average rates used by major banks, determine loan and financing installments, and even calculate IOF and CET rates. The app also provides a clear and concise summary of all costs involved in your credit operation, ensuring complete transparency. Let CredSimulator be your guide in making informed financial decisions.

Features of Simulador Empréstimo Bancário:

Accurate and Up-to-Date Information: Simulador Empréstimo Bancário provides you with the most current and reliable information about the rates practiced by Brazilian banks. This helps you make informed decisions when negotiating or renegotiating credit, portability, or financing contracts.

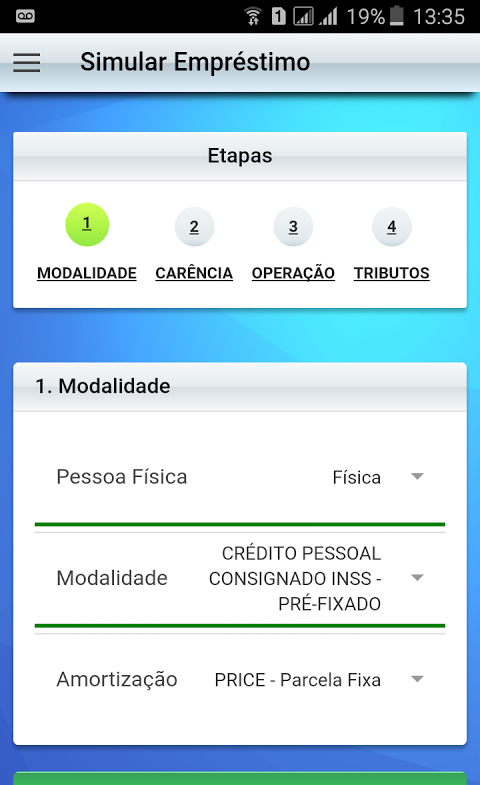

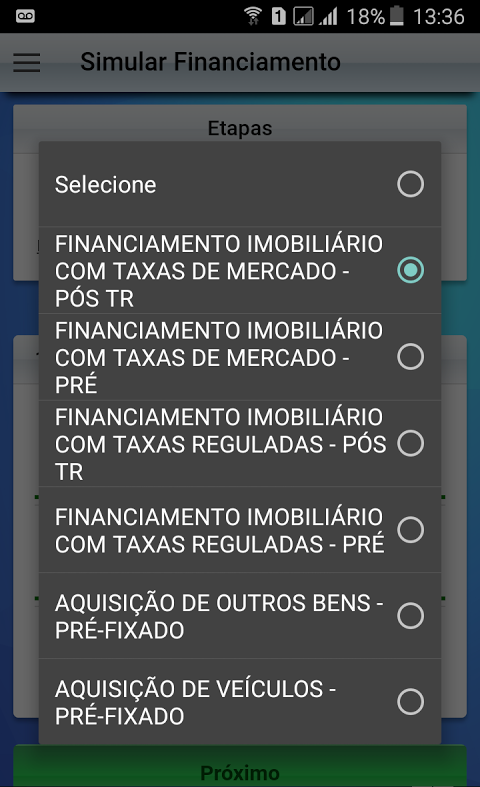

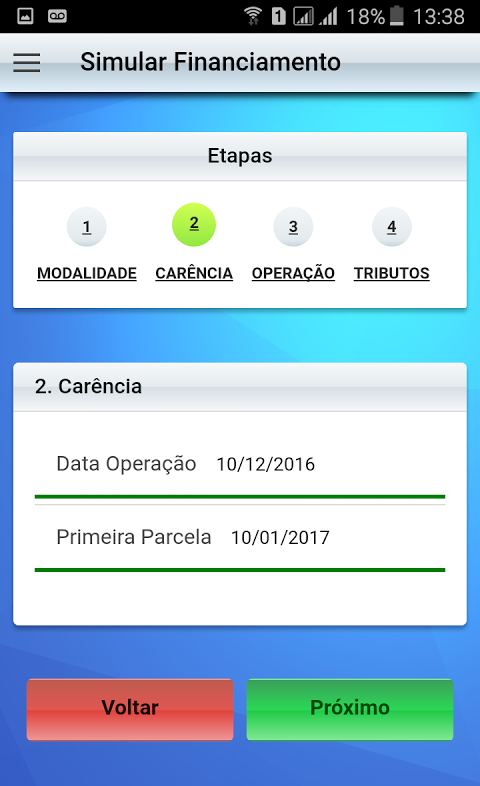

Comprehensive Calculations: The app offers a variety of calculation options, including installment calculation for loan, property, and vehicle financing. It also calculates the IOF (Imposto sobre Operações Financeiras) with updated rates and the CET (Custo Efetivo Total) rate, which represents the total cost of a credit operation. This comprehensive approach ensures that you have a clear understanding of all costs involved.

Convenient Sharing: With Simulador Empréstimo Bancário, you can easily share your simulation results with others. Whether you want to discuss it with a family member or a financial advisor, sharing the simulation helps facilitate discussions and gather opinions.

Summary Table: The app provides a summary table that showcases the values and percentages of each cost related to the credit operation. This feature ensures transparency and helps you visualize the breakdown of costs according to Resolution 4197 of the Central Bank.

Tips for Users:

Explore Different Scenarios: Use the app to simulate various scenarios by adjusting the interest rates, loan amounts, and repayment periods. This will help you compare different options and choose the most favorable one.

Consider Different Financing Options: Simulador Empréstimo Bancário allows you to calculate installment payments based on different financing methods, such as PRICE, SAC, and SAM (Mixed). Take advantage of these options to find the one that suits your financial needs and preferences.

Keep the Simulations Organized: Save and categorize your simulations within the app. This will enable you to easily access and review them later when comparing offers from different financial institutions or discussing with professionals.

Conclusion:

With its accurate information, comprehensive calculations, and convenient sharing features, Simulador Empréstimo Bancário empowers users to negotiate better credit terms and choose the most cost-effective options. By exploring different scenarios and considering various financing methods, users can save both time and money. Whether you are looking for a new loan, refinancing options, or simply want to understand the costs involved in credit operations, Simulador Empréstimo Bancário is the go-to app for all your financial needs.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16