Loan & Interest Calculator

Version:8.0

Published:2024-08-29

Introduction

The Loan & Interest Calculator App is a powerful tool that offers a range of calculators to help you make informed financial decisions. With features such as reverse loan calculations, pre-payments, and loan offset accounts, this app lets you explore different scenarios to find the best loan options for you. Additionally, the simple and compound interest calculators allow you to easily calculate interest for various deposit frequencies and compounding periods. Whether you're a student, an individual, or a financial professional, this app is a must-have for anyone looking to save time, effort, and money in their financial planning.

Features of Loan & Interest Calculator:

1) Loan Calculator:

- Reverse Loan calculations: Users can find out one of Loan amount, Interest rate, Loan term or Monthly repayment given the other 3 values.

- Make Pre-payments: Allows users to make extra repayments and find out interest savings and loan term reduction.

- Interest rate changes: Users can input changes to the interest rate and see the impact on monthly repayment and loan term.

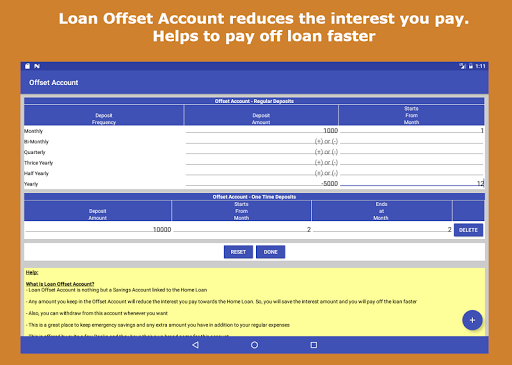

- Loan Offset Account: Helps users save on interest payments and pay off the loan faster.

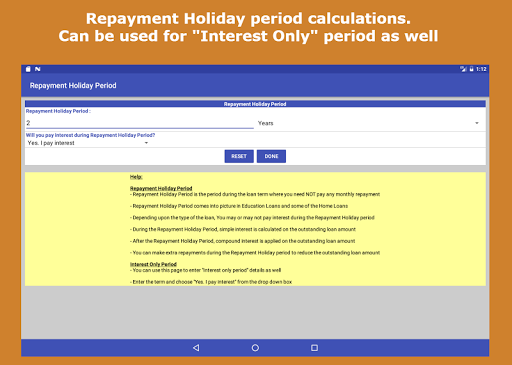

- Repayment Holiday calculations: Users can calculate interest-only periods.

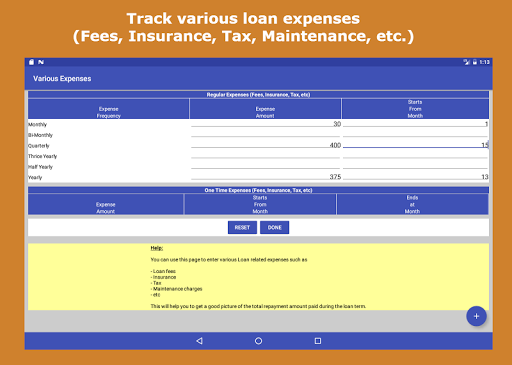

- Expense tracking: Allows users to track various loan expenses such as fees, insurance, tax, maintenance charges, etc.

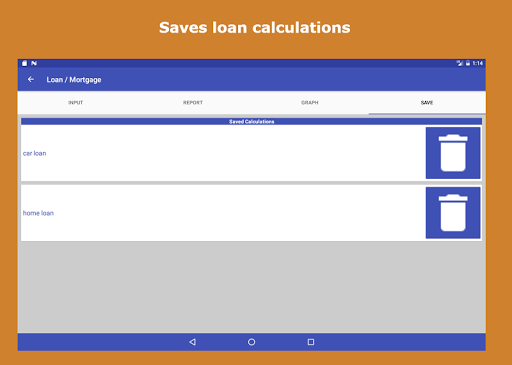

- Save loan calculations: Users can save their loan calculations for future reference.

2) Simple & Compound Interest Calculator:

- Calculates positive and negative amounts.

- Calculates compound interest for lump sum deposit/withdraw, regular deposit/withdraw, and both.

- Various deposit/withdraw frequencies: Users can choose from daily, weekly, fortnightly, monthly, bi-monthly, quarterly, thrice-yearly, half-yearly, and yearly frequencies.

- Ability to increase or decrease the regular deposit/withdraw amount every year by a certain amount or percentage.

- Ability to specify a particular term for regular deposit/withdraw regardless of the total term.

- Various compounding frequencies: Users can choose from daily, weekly, fortnightly, monthly, bi-monthly, quarterly, thrice-yearly, half-yearly, and yearly frequencies.

- Positive or negative interest rate: Helps in calculating profit or loss scenarios.

- Displays maturity amount, total amount deposited, and total interest earned.

- Yearly and monthly reports in a tabular format.

- E-mailing of reports.

- Visual representation through graphs and charts.

- Calculates simple interest as well.

- In-built user guide.

3) User Interface Features:

- Elegant Material Design Theme.

- Easy to use interface with tabs.

- App works on phones and tablets.

- Basic and advanced calculation modes.

- Fast calculation.

- Light weight and quick loading.

- Compatible with Android version 3 and above.

- No internet connection required.

Tips for Users:

1) Loan Calculator:

- Experiment with different loan amounts, interest rates, and loan terms to find the best repayment options.

- Take advantage of the pre-payment feature to reduce interest payments and shorten the loan term.

- Use the loan offset account to save on interest payments and pay off the loan faster.

- Track various loan expenses to get a comprehensive understanding of the total cost of the loan.

- Save loan calculations for future comparison and reference.

2) Simple & Compound Interest Calculator:

- Play around with different deposit frequencies and amounts to see how it affects the compound interest.

- Adjust the regular deposit/withdraw amount every year to match changing financial goals.

- Compare different compounding frequencies to choose the one that maximizes returns.

- Use the yearly and monthly reports to track the growth of investments over time.

- Visualize results through intuitive graphs and charts for better understanding.

Conclusion:

With Loan & Interest Calculator's features such as reverse loan calculations, pre-payments, interest rate changes, and expense tracking, users can make informed decisions about their finances. The simple and compound interest calculator allows users to calculate various scenarios and visualize results through graphs and charts. The user interface is easy to navigate, and the app works on both phones and tablets. Whether users are individuals, financial planners, accountants, or students, this app provides a valuable resource for financial planning, budgeting, and investment analysis.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16