Payactiv

Version:2.1.91

Published:2024-09-05

Introduction

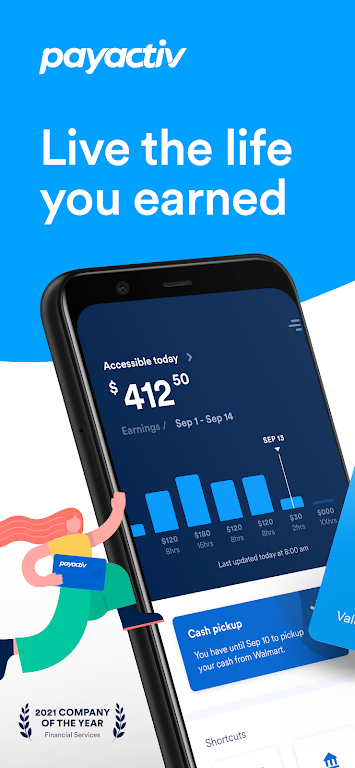

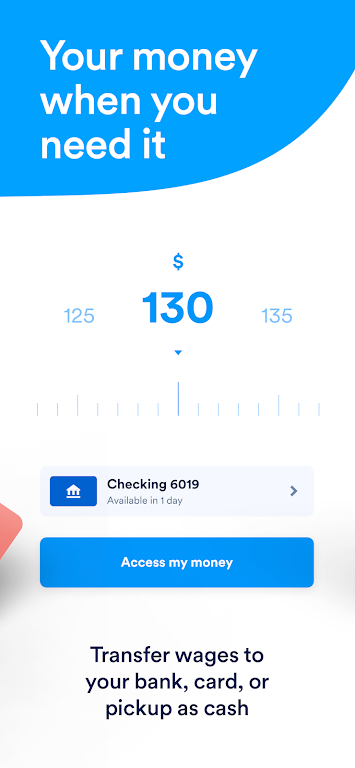

Introducing Payactiv, the app that puts your hard-earned money right at your fingertips. Say goodbye to waiting for payday and hello to financial stability. With it, you can access your wages before payday, pay bills on time to avoid late fees, and handle unexpected expenses with ease. No loans, no interest, just your money when you need it most. Plus, it offers a range of tools to help you achieve your financial goals, from spending and saving tools to the Payactiv Visa Card, designed without hidden fees.

Features of Payactiv:

Earlier access to your money:

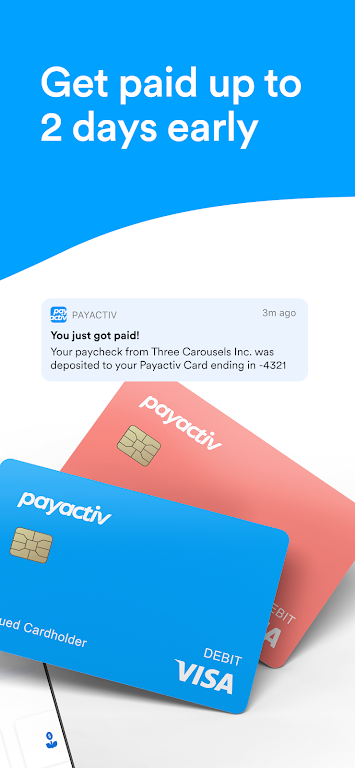

- With it, you can enjoy your paycheck up to 2 days early and receive government payments up to 4 days early. This means you can have immediate access to your hard-earned wages, giving you more control over your finances.

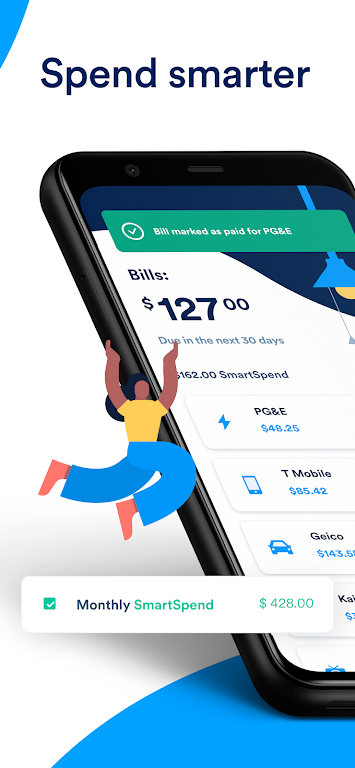

Spending and saving tools to achieve your financial goals:

- It provides user-friendly digital tools that help you stay informed about what's safe to spend, track your spending habits, and receive low balance alerts. With automatic transfers from earned wages, you can easily save for your financial goals.

The Visa Card: A card designed without hidden fees:

- Unlike traditional banking options, the Visa Card has no minimum balance requirements, no overdrafts, and no monthly or inactivity fees. You can access surcharge-free withdrawals MoneyPass ATMs, enjoy free integrated bill pay, and even withdraw cash at tellers in participating banks.

Convenience and security you can rely on:

- It offers seamless integration with Google Pay or Apple Wallet, allowing you to make touchless payments at stores. The Visa Card also provides Visa's Zero Liability protection, ensuring your money is secure. In case of a lost or stolen card, you can easily lock or replace it. Additionally, it offers 24/7/365 support in English and Spanish.

FAQs:

Is it a loan service?

No, it does not provide loans. It allows you to access your earned wages before payday without any interest charges.

How can I track my spending habits with it?

It provides easy-to-use tools that allow you to track your spending habits at a glance. You can stay informed about what's safe to spend and receive low balance alerts.

Are there any fees associated with the Visa Card?

No, the Visa Card has no hidden fees. There are no minimum balance requirements, overdraft fees, or monthly or inactivity fees.

Conclusion:

With Payactiv, you can take control of your finances and achieve your financial wellness goals. By providing earlier access to your money, spending and saving tools, a fee-free Visa card, and convenient and secure features, Payactiv empowers you to stay on top of your financial situation. Say goodbye to late fees and overdraft charges, and say hello to a brighter financial future with Payactiv. Download the app now and experience the benefits for yourself.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16