SIDBIREA

Version:2.9

Published:2024-09-10

Introduction

Introducing SIDBIREA, the app that aims to support the sustainable development of the MSME sector in India. As the principal financial institution for MSMEs, SIDBI provides a wide range of specialized financial products to meet the credit requirements of these businesses. But it doesn't stop there. With a track record of channelizing over $1 billion for energy efficiency and cleaner production projects, SIDBI is committed to driving innovation and entrepreneurship in the MSME sector, ensuring its survival and growth in the future.

Features of SIDBIREA:

⭐ Promotion and Financing of MSMEs: It serves as the principal financial institution for the promotion, financing, and development of MSMEs in India. It offers specialized fund-based and non-fund-based financial products to meet the credit requirements of the MSME sector.

⭐ Green Technology Financing: It has expanded its offerings to include financing for energy-efficient and green technologies. This initiative promotes sustainable development in the MSME sector and presents a great opportunity for the banking sector.

⭐ Bilateral Lines of Credit: It has contracted bilateral Lines of Credit from international organizations such as Japan International Cooperation Agency (JICA), KfW, and AFD to scale up its energy efficiency financing. This allows for the implementation of energy-efficient measures in the production process.

⭐ World Bank Support: It has availed a World Bank Line of Credit to promote clean technologies and environmental and social standards in the MSME sector. This support has enabled SIDBI to channelize over USD 1 billion in loan assistance for energy efficiency and cleaner production projects in MSMEs.

Tips for Users:

⭐ Explore the Specialized Financial Products: It offers a wide range of fund-based and non-fund-based financial products specifically tailored for the needs of MSMEs. Take the time to explore these options and choose the ones that best suit your business requirements.

⭐ Consider Energy-Efficient Investments: With its focus on financing green technologies, consider investing in energy-efficient measures for your business. These not only contribute to sustainable development but also have the potential to reduce costs and improve competitiveness.

⭐ Utilize Bilateral Lines of Credit: Make use of the bilateral Lines of Credit contracted by SIDBI. These financing options can provide support for implementing energy-efficient measures in your production process. Explore the terms and conditions of each line of credit to understand the benefits they offer.

Conclusion:

SIDBIREA, the principal financial institution for MSMEs in India, offers a comprehensive range of financial products to meet the credit requirements of the sector. With a focus on promoting sustainable development and green technologies, SIDBI has scaled up its financing for energy efficiency projects. Through bilateral Lines of Credit and support from international organizations such as the World Bank, SIDBI has successfully channeled over USD 1 billion in loan assistance for energy efficiency and cleaner production projects in MSMEs.

Show More

Information

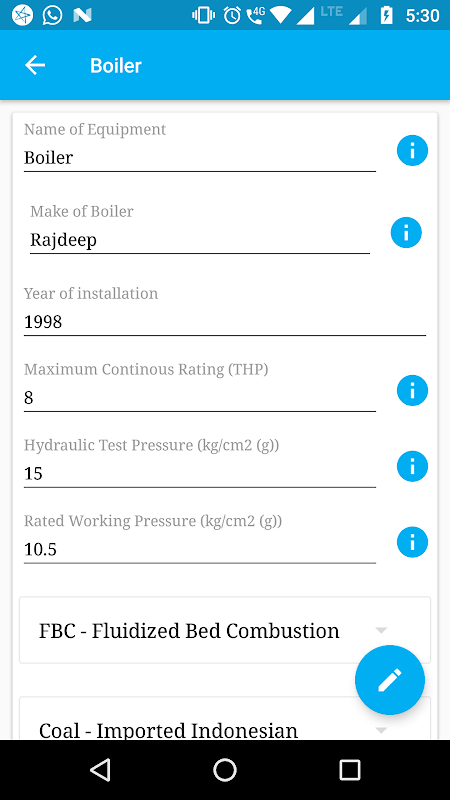

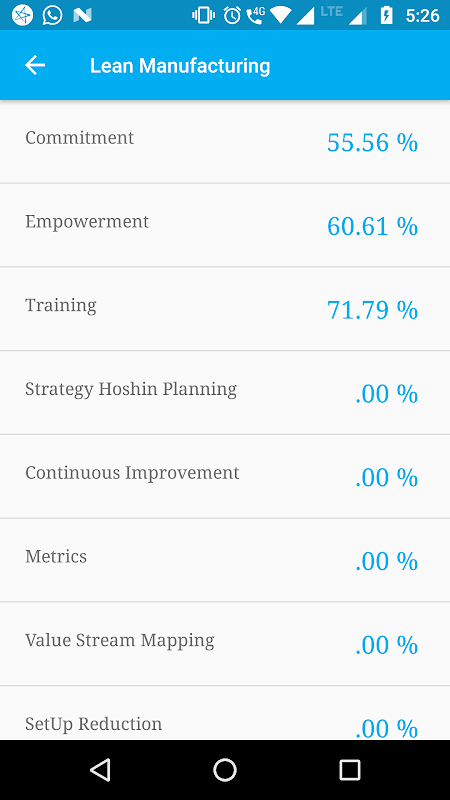

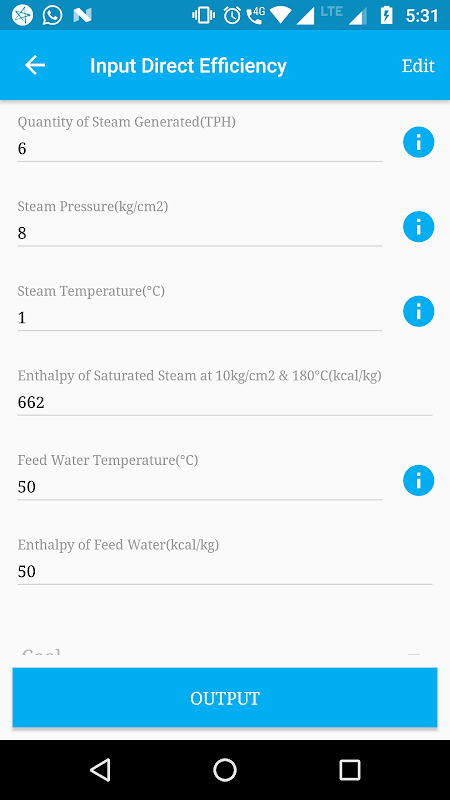

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16