Oakam

Version:4.2.1

Published:2024-09-11

Introduction

Oakam is an innovative and user-friendly app that aims to break down financial barriers and provide access to loans for individuals who may have previously been overlooked. Whether you're on benefits, have a bad credit history, or have just arrived in the UK, it is here to listen to your story. With it, you're always in control. You can choose from flexible payment plans, without the worry of late fees or penalties for settling early. What sets it apart is that they empower you to build a brighter financial future.

Features of Oakam:

⭐ Accessible to All: It strives to break down financial barriers and provide access to individuals who are on benefits, have a bad credit history, or have recently arrived in the UK. This inclusive approach sets it apart from traditional lenders and ensures that everyone has a chance to improve their financial situation.

⭐ Privacy and Convenience: Money is a private matter, and it respects that. They will never knock on your door, allowing you to maintain your privacy. Instead, it offers online and phone support, making it convenient for customers to reach out for assistance whenever they need it.

⭐ Flexible Repayment Options: It understands that everyone's financial situation is unique. That's why they offer weekly or 2-weekly payment plans, allowing you to choose the schedule that works best for you. This flexibility ensures that you can repay your loan in a way that aligns with your budget.

⭐ Transparent Terms: It believes in simplicity and transparency. They do not charge late fees or penalize you for settling your loan early. This transparent approach gives you peace of mind and eliminates any hidden costs or surprises.

Tips for Users:

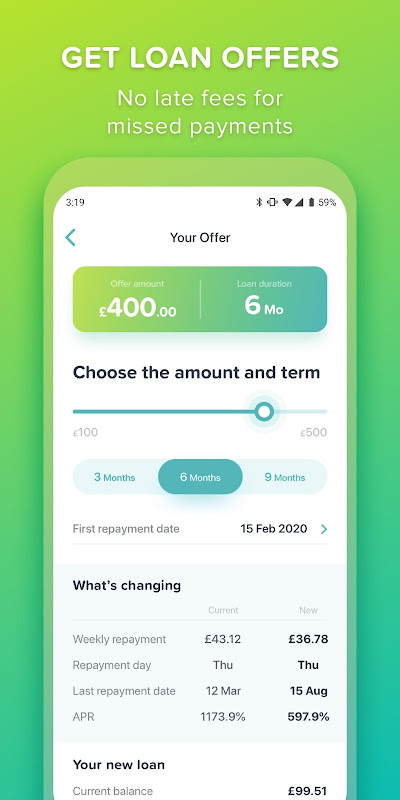

⭐ Compare and Customize Loan Offers: It allows you to see available loan offers and customize them based on your preferences. Take your time to compare different options and select the one that best suits your needs.

⭐ Stay on Top of Your Repayment Schedule: The app provides helpful notifications to keep you on track with your repayment schedule. Make sure to enable these notifications and set reminders so that you never miss a payment. it also offers rewards for paying on time, providing extra motivation to stay organized.

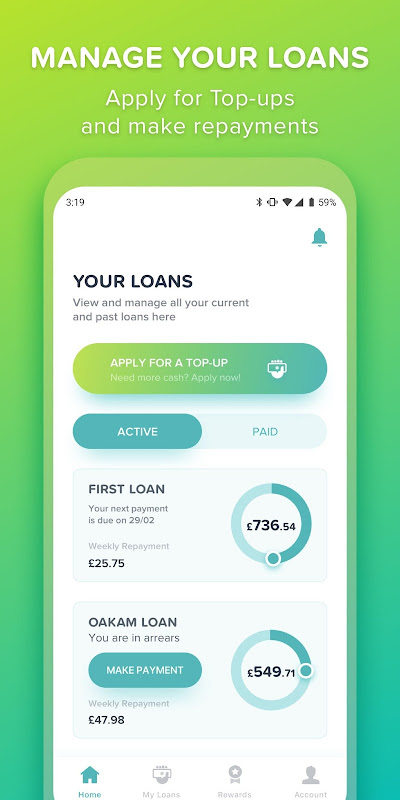

⭐ Utilize In-App Loan Payments and Top-Ups: The app makes it easy to manage your existing loans. Take advantage of the convenient in-app loan payment feature to ensure timely repayments. Additionally, if you demonstrate good repayment behavior, you may have the flexibility to top-up your loan at a lower price.

Conclusion:

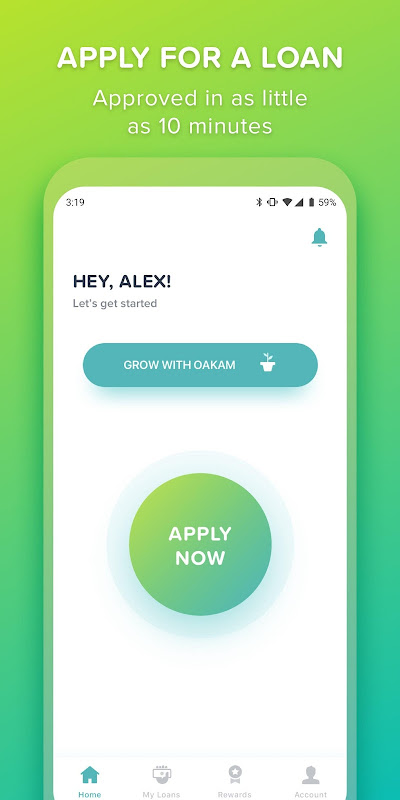

Oakam is to make financial services accessible to all. With their inclusive approach and commitment to privacy, they create a safe and convenient environment for users to manage their finances. The flexibility of repayment options and transparent terms further enhance the user experience. The app simplifies the borrowing process, allowing users to apply for loans and get approved in as little as 10 minutes. By utilizing the app's features, such as comparing loan offers, staying on top of repayments, and managing existing loans, users can take full control of their financial future. Experience the ease and convenience of it today.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16