MFI Expert

Version:3.2000

Published:2024-09-11

Introduction

MFI Expert is a comprehensive and technologically advanced microfinance app that is designed to provide exceptional services to microfinance institutions. With its scalable and pre-configured core system, this app allows MFIs to enhance customer satisfaction, fuel innovation, and extend their competitive advantage. Whether you are a small community-based institution or a large deposit-taking microfinance operation, it offers a wide range of features to support all your banking operations.

Features of MFI Expert:

❤ Enhanced Efficiency: It offers a flexible and scalable microfinance system that streamlines processes, allowing credit-only microfinance institutions to onboard clients quickly and process loans faster. This improved efficiency saves time and enables MFIs to serve more customers effectively.

❤ Comprehensive Support: The software provides comprehensive features to support a wide range of microfinance and banking operations. From managing memberships and savings accounts for Sacco/Chama/Credit Unions to hire purchase finance documentation and collateral tracking, it caters to various financial needs.

❤ Technological Competitive Edge: With its advanced technology and flexible functionality, it gives microfinance institutions a competitive edge. It offers a unique value proposition to customers by integrating with commercial ERP systems and allowing third-party integrations, providing MFIs with extensive capabilities.

❤ Customer Self-Service: It empowers borrowers by enabling them to access their information easily through various channels like a mobile app, USSD, or SMS. This self-service feature enhances customer satisfaction and convenience by giving them control over their financial information.

Tips for Users:

❤ Take Advantage of On-Boarding Flexibility: Credit-only microfinance institutions can utilize its flexible environment for on-boarding clients. Leverage the system to streamline the client acquisition process and ensure faster loan approvals.

❤ Optimize Documentation Management: Hire purchase finance companies can benefit from its robust documentation management capabilities. Utilize the software to track and manage documentation, payment schedules, collateral, and penalties efficiently.

❤ Explore Third-Party Integrations: Take advantage of its ability to integrate with popular commercial ERP systems such as Salesforce, SAGE, Oracle E-Business, and more. This integration will complement the software's functionalities and enhance the overall efficiency of your operations.

Conclusion:

MFI Expert offers numerous attractive points. Its enhanced efficiency and flexibility assist credit-only microfinance institutions in on-boarding clients and processing loans faster. The software caters to different types of microfinance operations, from Sacco/Chama/Credit Unions to hire purchase finance companies. It stands out from the competition due to its integration capabilities, allowing it to seamlessly connect with commercial ERP systems and other third-party applications. By adopting it, microfinance institutions can enhance customer satisfaction, drive innovation, and stay competitive in today's business landscape.

Show More

Information

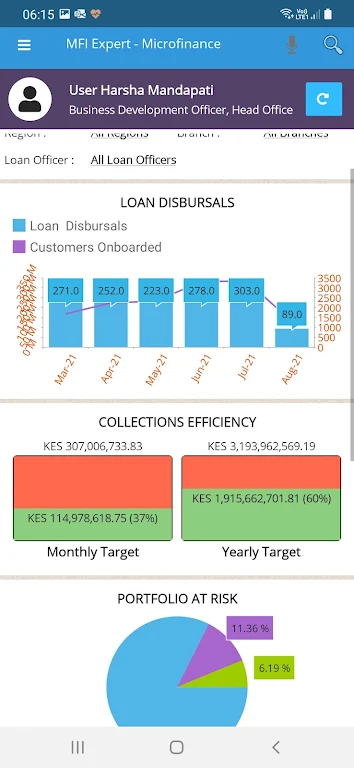

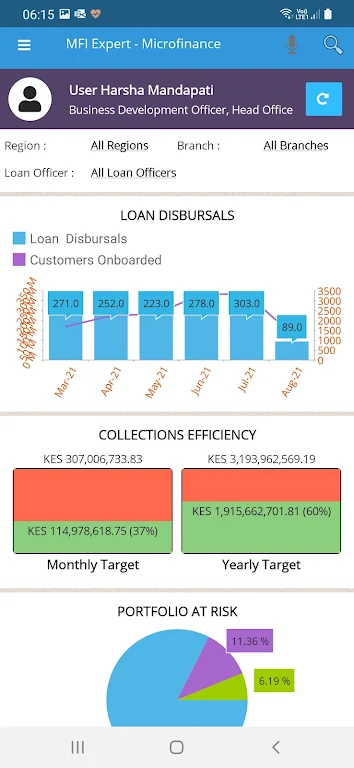

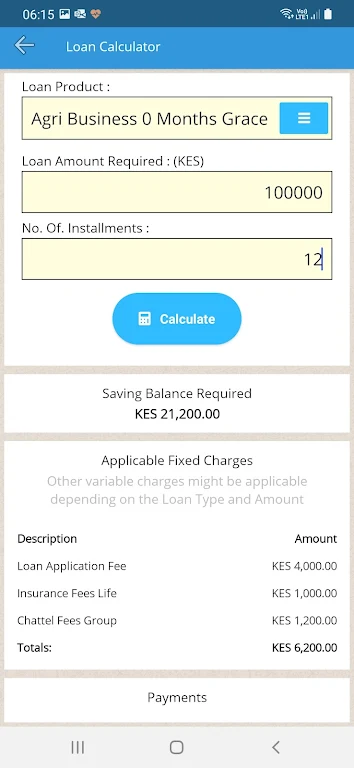

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16