CIBIL Score estimator

Version:1.7.0

Published:2024-09-20

Introduction

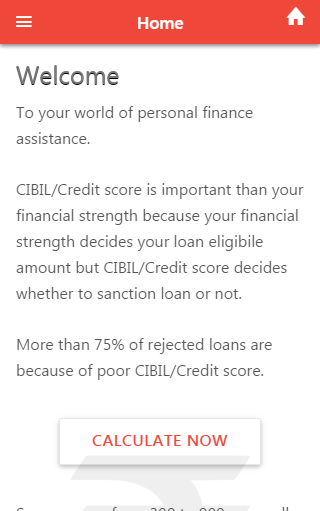

CIBIL Score estimator is the ultimate app for anyone who wants to take control of their financial future. In today's world, a good credit score, also known as a CIBIL Score, is more important than ever. Unfortunately, many people are completely unaware of the impact their credit score has on their personal finances. That's where CreditSUKI comes in. It not only allows you to calculate your approximate credit score, but it also gives you valuable insights into the factors that are affecting your score.

Features of CIBIL Score estimator:

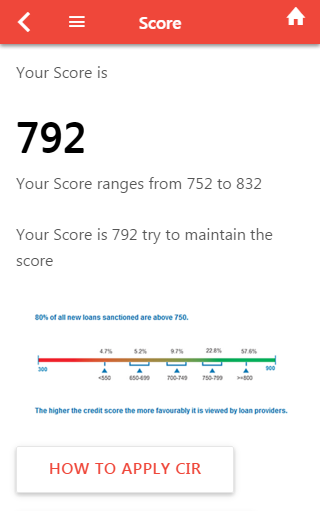

⭐ Easy Credit Score Calculation: It provides a convenient way to calculate your approximate credit score (CIBIL Score) without the need for complicated calculations or financial knowledge. This feature makes it accessible to anyone, even those with limited financial literacy.

⭐ Factors Affecting Credit Score: Understanding the factors that affect your credit score (CIBIL Score) is crucial for improving your financial situation. It helps you identify and comprehend these factors, providing valuable insight into how your financial decisions impact your creditworthiness.

⭐ Tips for Credit Score Improvement: Improving your credit score (CIBIL Score) can have a significant impact on your financial well-being. It offers expert tips and recommendations tailored to your specific credit situation, helping you take actionable steps towards a better score and better financial opportunities.

⭐ Loan Comparison and Saving Analysis: One of the key benefits of using CreditSUKI is the ability to calculate how much more you pay for loans at different interest rates. This feature allows you to make informed decisions when comparing loan offers, ensuring that you save money and find the best borrowing options.

Tips for Users:

⭐ Regularly Monitor and Track Your Credit Score: Make it a habit to monitor and track your credit score (CIBIL Score) using CreditSUKI. This will help you stay updated with any changes and identify areas where you can improve.

⭐ Pay Your Bills on Time: Timely bill payments contribute significantly to a good credit score (CIBIL Score). Set up reminders or automate payments to ensure you never miss a payment and maintain a positive credit history.

⭐ Reduce Credit Utilization: Aim to keep your credit utilization ratio below 30%. CreditSUKI provides tips on managing your credit utilization effectively, helping you maintain a healthy credit profile.

Conclusion:

With CIBIL Score estimator's easy credit score calculation, insights into factors affecting your score, tailored tips for improvement, and loan comparison feature, it empowers you to take control of your personal finances. Regular monitoring, timely bill payments, and responsible credit utilization are key strategies recommended by CreditSUKI to boost your credit score. By leveraging the expert analysis and suggestions provided, you can systematically improve your credit score and unlock better financial opportunities. Take charge of your creditworthiness with CreditSUKI today.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16