MoMo

Version:2.2.8

Published:2024-11-23

Introduction

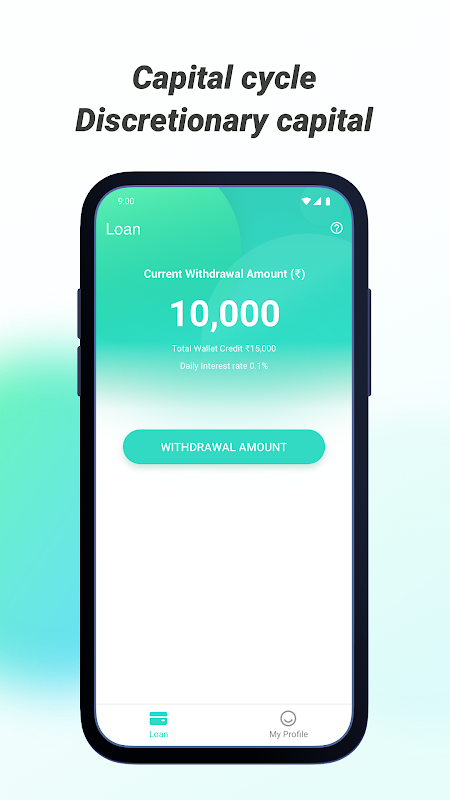

Experience financial freedom with the MoMo app, the revolutionary credit app that allows you to borrow and repay at your convenience. With loan amounts ranging from ₹3,000 to ₹30,000 and a competitive interest rate of 36% per annum for 60 days, the app provides you with the flexibility and support you need. What sets the app apart is the option for multiple loan cycles within 60 days, each with a 15-day repayment period and the ability for partial repayment. The quick and hassle-free application process coupled with immediate bank transfers and easy repayment options make the app the ideal solution for any cash crunch.

Features of MoMo:

* Payback and use again immediately: The app allows users to borrow and repay at any time, and the credit support can be used for multiple cycles. Once a loan is repaid, users can immediately borrow again, providing a convenient and flexible borrowing experience.

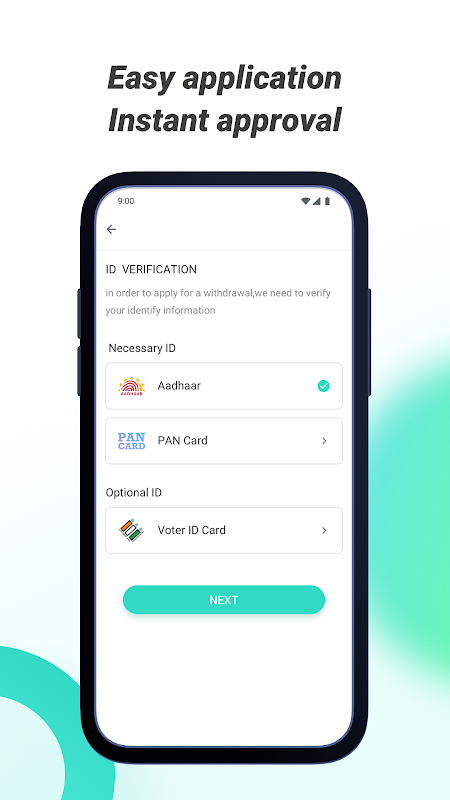

* 100% Online process: The entire process, from registration to loan application and approval, is done online through the app. Users can create their profile in minutes and apply for a loan without the hassle of visiting a physical location.

* Credits given by comprehensive credit score: The app determines the credit limit based on the user's comprehensive credit score. This means that users with a good credit history can enjoy a higher credit limit, making it easier for them to borrow larger amounts when needed.

* No guarantee/security required: Unlike traditional loans that require collateral or a guarantor, the app does not require any guarantee or security. This makes it accessible to a wider range of users who may not have assets to provide as collateral.

Tips for Users:

* Utilize the partial repayment option: The app allows users to make partial repayments when their loan is due. This can help reduce the financial burden and make it easier to repay the loan on time.

* Plan your repayments in advance: With a repayment period of 15 days for each loan, it's important to plan your repayments in advance to avoid any late fees or penalties. Set reminders or notifications to ensure you repay on time.

* Apply for a higher credit limit: By maintaining a good credit history, you can increase your chances of getting a higher credit limit on the app. This can be beneficial when you need to borrow larger amounts in the future.

Conclusion:

MoMo is a convenient and flexible revolving credit app that allows users to borrow and repay at any time. With features like payback and use again immediately, online process, credits given by comprehensive credit score, and no guarantee/security required, it provides a user-friendly experience for those in need of quick cash. By utilizing the playing tips like partial repayment and planning repayments in advance, users can make the most out of the app's services. Download the app now from the Google Play store and enjoy fast approval, immediate bank transfers, and easy repayment options. Create your profile, apply for a loan, and dispel that cash crunch today!

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16