PDF Form 1099 S for IRS: Sign Tax Digital eForm

Version:1.9.3

Published:2024-11-25

Introduction

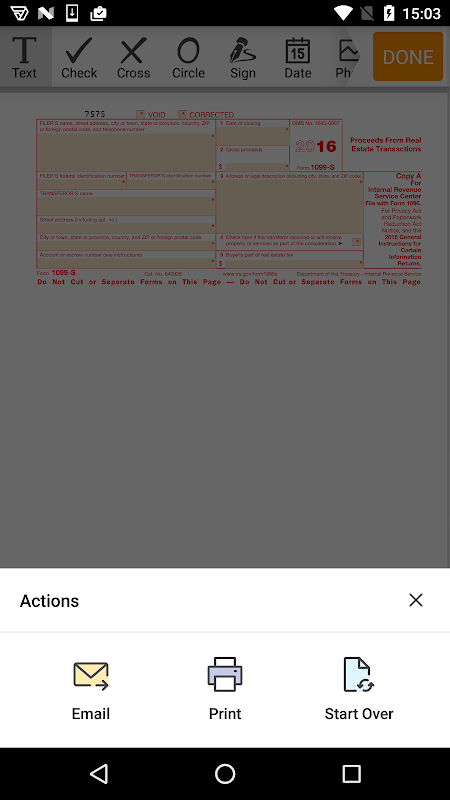

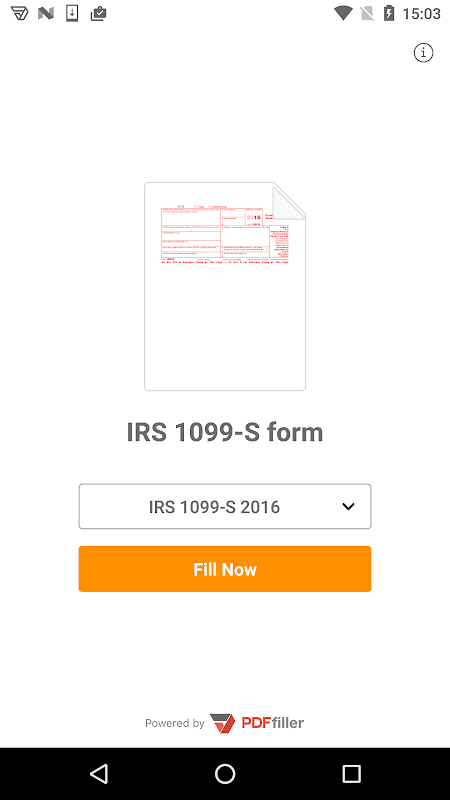

Introducing the PDF Form 1099 S for IRS: Sign Tax Digital eForm app - the ultimate solution for filing your informational return to the IRS conveniently and securely from your smartphone or tablet. With this app, you can say goodbye to cumbersome paper copies and file the form anytime, anywhere. Our app ensures the protection of your personal information with its secure connection and data encryption methods. The multi-functional toolkit of this app allows you to easily add any textual or numeric information required, as well as checkmarks, cross signs, images, and graphic lines. Navigation between the 1099S fields is a breeze, and you can even include the current date automatically or manually. What's more, you can certify the document with a legally binding signature - simply draw it with your finger and it will fit perfectly in the signature field.

Features of PDF Form 1099 S for IRS: Sign Tax Digital eForm:

* Add Textual and Numeric Information: The app allows users to easily add any textual or numeric information required in the eForm. Whether it's names, addresses, or monetary amounts, users can input the necessary data with ease.

* Add Checkmarks, Cross Signs, Images, and Graphic Lines: Users can enhance their 1099 S form by adding checkmarks, cross signs, images, and graphic lines. This allows for better organization and clarity when filling out the form.

* Easy Navigation and Date Inclusion: Navigating between the blank 1099S fields is a breeze with the app's intuitive interface. Users can also include the current date, both automatically and manually, ensuring accuracy and completeness.

* Legally Binding Signature: The app offers a convenient way to certify the document with a legally binding signature. Users can simply draw their signature with their finger, and it will fit perfectly in the signature field.

Tips for Users:

* Familiarize Yourself with Reporting Requirements: Before using the app, it's important to understand the reporting requirements for Form 1099 S. Only sales that meet certain criteria, such as a minimum amount or type of property, need to be reported.

* Keep Documentation Handy: To avoid any potential problems or penalties from the IRS, make sure to provide all necessary documents beforehand. This includes any information related to the financial transaction, such as sales contracts or property records.

* Review and Double-Check: After completing the form digitally, take the time to review and double-check all the information entered. This will help ensure accuracy and prevent any mistakes or omissions.

Conclusion:

With PDF Form 1099 S for IRS: Sign Tax Digital eForm app, filing Form 1099 S has never been easier or more convenient. Users can add all the necessary information, enhance the form with various features, and digitally sign the document, all from their smartphone or tablet. The app's user-friendly interface and seamless navigation make the process straightforward and efficient. By using our app, you can save time, eliminate the hassle of paper copies, and ensure the security of your personal information. Simplify your tax filing process and download the PDF Form 1099 S for IRS app today.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16