Credit Manager

Version:3.59

Published:2024-11-26

Introduction

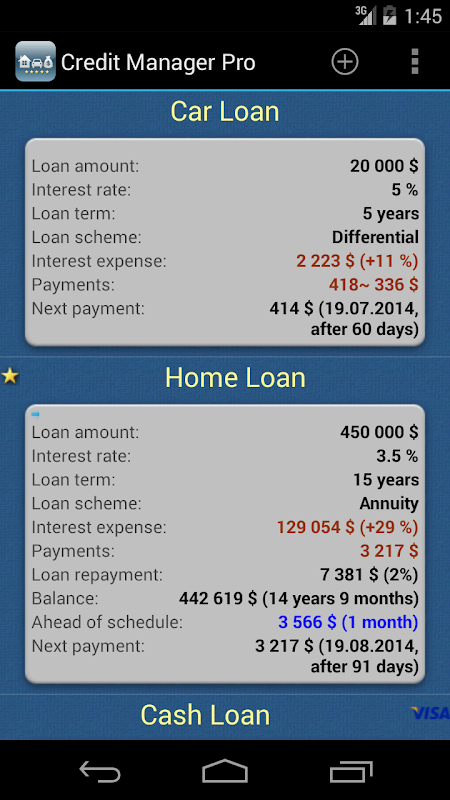

Introducing the powerful Credit Managerapp! With its smart features, you can easily manage your loans and stay on top of your financial situation. This app does it all - calculating your payment schedule, keeping track of completed payments, and even providing a reminder for your next payment. Plus, it goes a step further with the ability to calculate your outstanding balance and change interest rates (in the pro version). Worried about accidentally deleting important loan information? Don't be! The app offers protection against accidental deletions and keeps your data secure with password protection (in the pro version).

Features of Credit Manager:

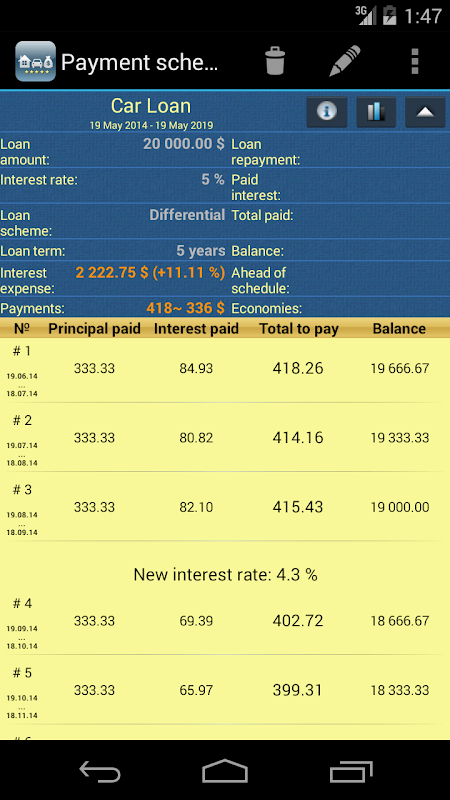

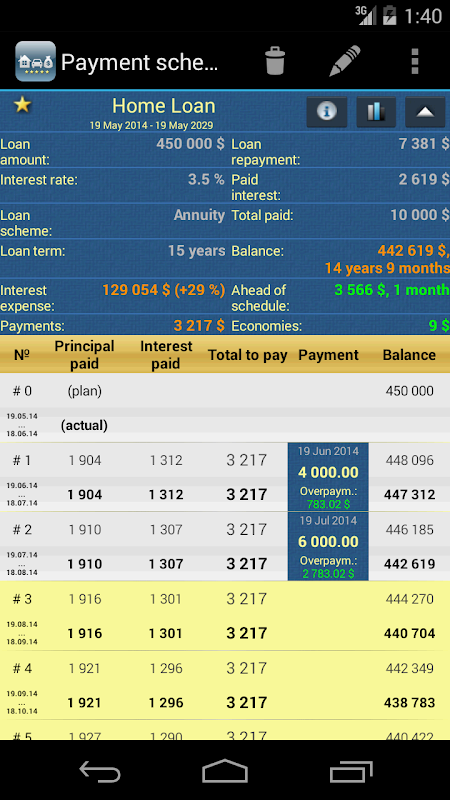

- Easy Loan Payment Calculation: The app simplifies the process of calculating your loan payment schedule. Whether you opt for standard or annuity payments, the app will do all the math for you. Simply input your loan details, and the app will generate a comprehensive payment schedule.

- Track Completed Payments: Keep track of your progress with the app's built-in statistics feature. It provides a clear overview of all completed payments, helping you stay on top of your loan repayment journey. This feature allows users to visualize their progress and stay motivated to pay off their loan faster.

- Monitor Outstanding Balance: The app enables you to stay informed about the remaining balance on your loan. By knowing how much you have left to pay, you can plan your finances accordingly and make more informed decisions. This feature ensures transparency and helps users take control of their financial obligations.

- Payment Reminders (Credit Manager PRO): With the app, you can set up automatic reminders for upcoming loan payments. Never miss a payment deadline again, as the app will send timely notifications to keep you on track. This feature helps users avoid late payment fees and maintain a good credit score.

Tips for Users:

- Input Accurate Loan Details: To get the most accurate payment schedule and outstanding balance calculations, be sure to input the correct loan details into the app. This includes the loan amount, interest rate, and repayment period.

- Regularly Update Completed Payments: As you make loan payments, remember to update the app's statistics feature to keep an accurate record of completed payments. This ensures the app's calculations remain accurate and up-to-date.

- Take Advantage of Payment Reminders: If you have the Credit Manager PRO version, make sure to enable the payment reminder feature. This will help you stay organized and ensure timely payments, avoiding any penalties or credit score impacts.

Conclusion:

Credit Manager is a powerful tool for anyone managing loan payments. Its attractive features, such as easy payment calculation, comprehensive payment tracking, and outstanding balance monitoring, make it a must-have app for anyone with financial obligations. Additionally, the payment reminder feature in the PRO version adds convenience and peace of mind. By using the app, you can take control of your loan repayment journey and stay on top of your financial responsibilities. Download the app now to simplify your loan management experience.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16