Aella: Savings, Loans, Bills

Version:9.12.1

Published:2024-11-26

Introduction

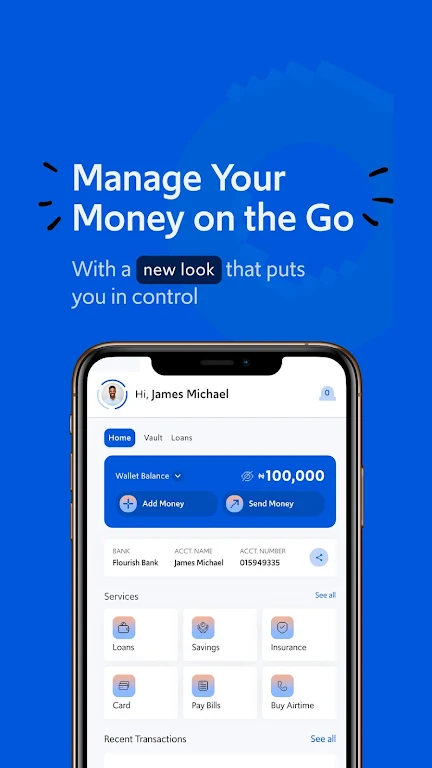

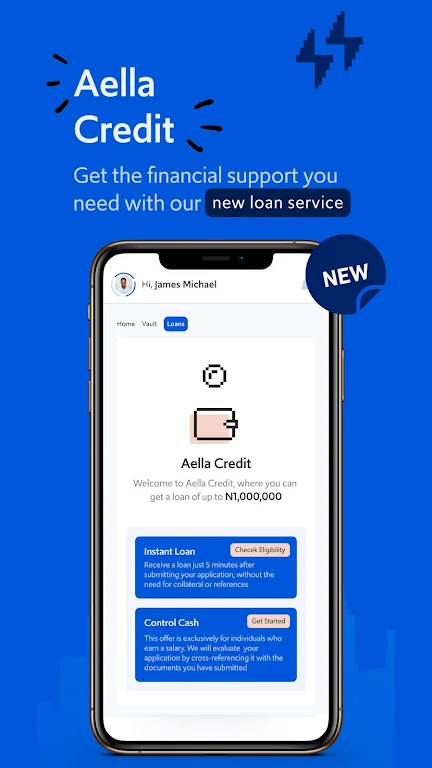

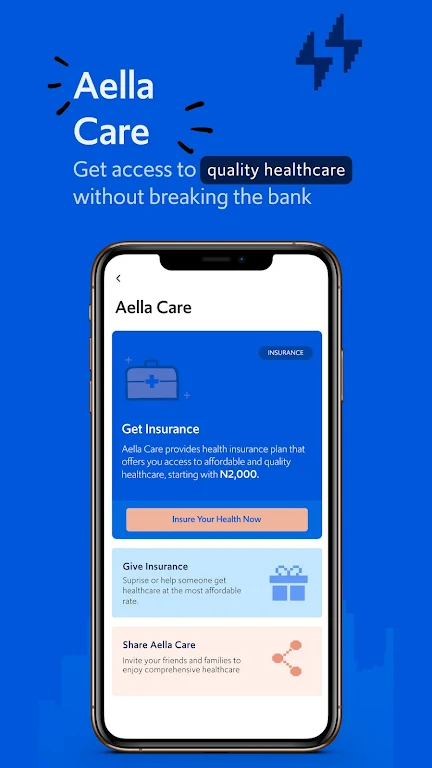

Introducing the Aella: Savings, Loans, Bills app, the ultimate fintech solution for your financial needs. With the app, accessing instant credit and managing your payments has never been easier. Whether you're looking for loans, investments, bill payments, micro-insurance plans, or money transfers, we've got you covered.Our Aella Credit feature allows you to secure loans in just 5 minutes, without the hassle of paperwork. Build your credit score and increase your limit with prompt repayments. All you need is your basic information, BVN, and a smartphone. When it comes to loans, we offer a wide range, from ₦2,000 to ₦1,500,000, with flexible tenors ranging from 61 days to 365 days. Our interest rates are competitive, ranging from 2% to 20%, with an APR from 22% to 264% per annum.

Features of Aella: Savings, Loans, Bills:

❤ Instant Access to Loans: With the app, you can easily apply for loans and receive funds within minutes. There is no need for paper documentation, making the process quick and hassle-free.

❤ Credit Building: By making prompt repayments on your loans, you can increase your credit score and eventually qualify for higher credit limits.

❤ Flexible Loan Options: The app offers loan amounts ranging from ₦2,000 to ₦1,500,000 with tenors of 61 days to 365 days. This flexibility allows you to choose a loan that suits your specific financial needs.

❤ Transparent Pricing: The app provides clear loan rates and fees, ensuring that you understand the cost of borrowing. There are no hidden or late fees, and the early repayment discount offers further savings.

Tips for Users:

❤ Keep a Good Repayment Record: By repaying your loans on time, you can build a positive credit history, which will help improve your chances of getting approved for higher loan amounts in the future.

❤ Borrow Only What You Need: While the app offers a wide range of loan amounts, it is important to borrow only what you need and can comfortably repay. This will help you avoid unnecessary debt.

❤ Take Advantage of Early Repayments: If you have the means to do so, consider making early repayments on your loans. Not only will this save you money on interest, but it will also improve your credit score.

Conclusion:

With the Aella: Savings, Loans, Bills app, you can easily access loans, make bill payments, and manage your finances in one convenient app. The instant loan feature eliminates the lengthy approval process, allowing you to meet your financial needs quickly. The transparent pricing and flexible loan options ensure that you have control over your borrowing and repayment journey. By using the app responsibly and taking advantage of the credit building opportunities, you can improve your financial independence and achieve your goals. Download the app today and simplify your financial life.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16