VA Loans - FAQ & Tips

Version:100.0

Published:2024-11-27

Introduction

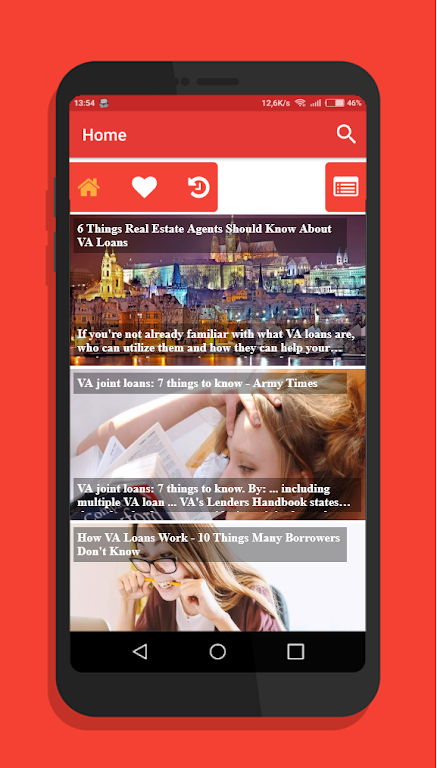

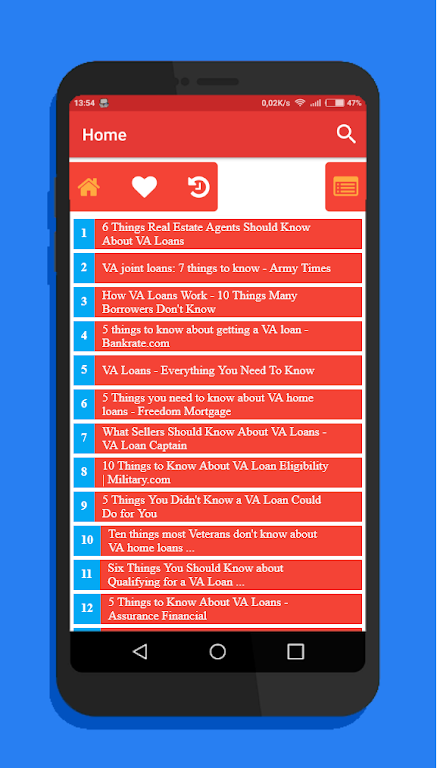

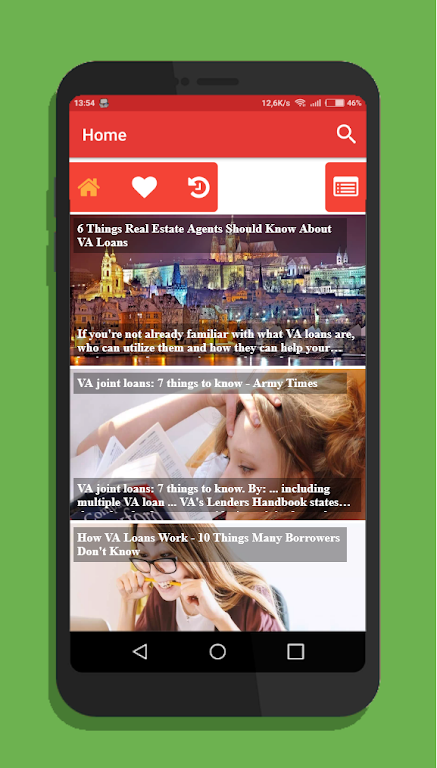

Are you a veteran in need of affordable loans to meet your financial needs? Look no further than the VA Loans - FAQ & Tips app! Our commitment to providing veterans with accessible and affordable loans sets us apart from the competition. With lower interest rates and flexible repayment options, the app ensures that veterans can borrow the money they need without breaking the bank. Our quick and easy online application process means that you can complete the entire process from the comfort of your own home. Plus, with no hidden fees or prepayment penalties, you can rest easy knowing that you won't be hit with any unexpected costs. Applying for the app as a veteran is a simple process, just follow our step-by-step guide and have your documents and information ready to get started.

Features of VA Loans - FAQ & Tips:

Lower interest rates and flexible repayment options: The app offers veterans lower interest rates compared to traditional loans, making it more affordable for them to meet their financial needs. Additionally, the flexible repayment options allow veterans to choose a payment plan that suits their budget and circumstances.

Quick and easy online application process: The app understands the importance of convenience, which is why they have a quick and easy online application process. Veterans can apply for a loan from the comfort of their own home, saving them time and effort.

No hidden fees or prepayment penalties: Transparency is a key feature of the app. They ensure that there are no hidden fees or prepayment penalties, giving veterans peace of mind knowing that they won't be surprised with additional charges.

Tips for Users:

Compare interest rates: Before applying for a loan, it's important to compare interest rates from different lenders including the app. This will help veterans choose the loan option with the lowest rate, saving them money in the long run.

Prepare the necessary documents: To expedite the application process, veterans should gather all the necessary documents and information required by the app. This includes identification, proof of income, and any other supporting documentation.

Understand the repayment terms: It's crucial for veterans to fully understand the repayment terms before accepting a loan from the app. They should carefully review the length of the loan, monthly payment amounts, and any potential penalties or fees.

Conclusion:

VA Loans - FAQ & Tips is a top choice for veterans in need of affordable and accessible loans. With lower interest rates, flexible repayment options, and a quick online application process, they provide veterans with a convenient and transparent lending solution. By comparing the app with traditional loans, veterans can see the advantages in terms of interest rates and collateral requirements. Whether it's consolidating debt or managing finances, the app is dedicated to supporting veterans and improving their financial status. Apply with the app today to experience their exceptional service and benefits.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16