NSC Interest Calculator

Version:1.0.7

Published:2024-11-28

Introduction

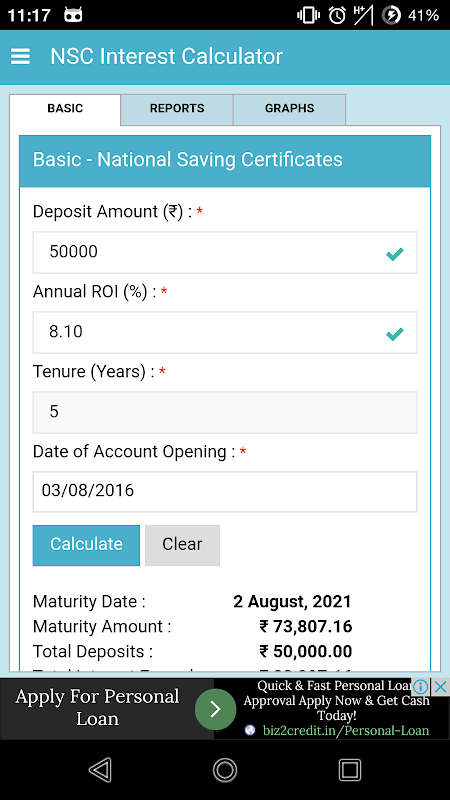

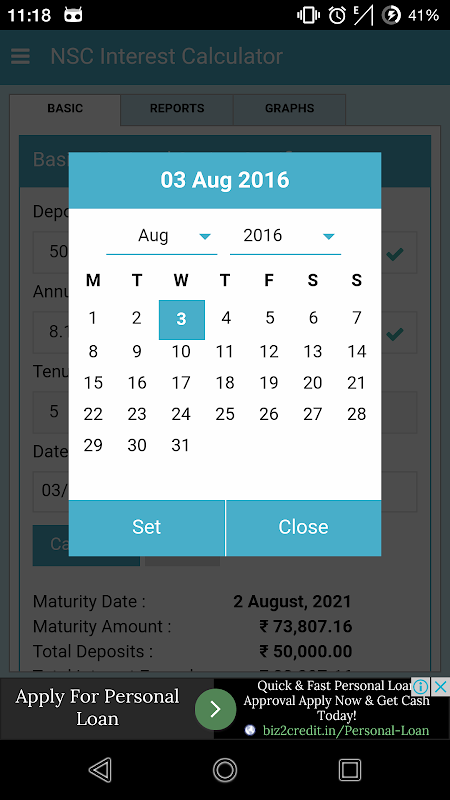

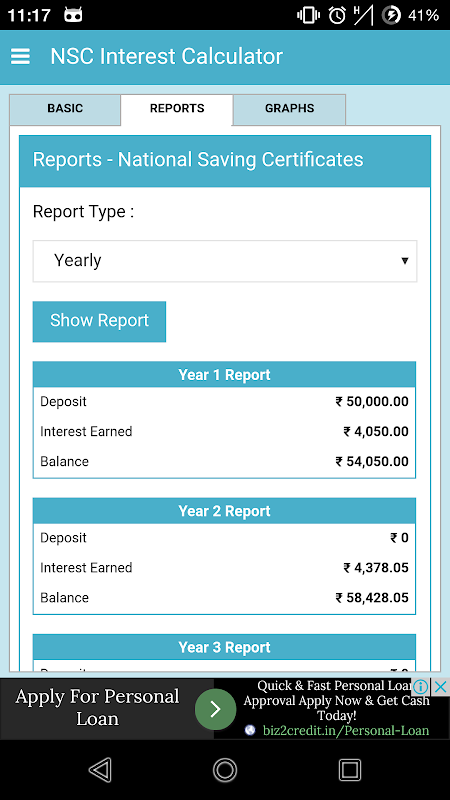

Introducing the NSC Interest Calculator, a handy app designed to help you calculate the maturity amount of your National Savings Certificates (NSC) invested in India's Post Office. Whether you're an adult, minor, trust, or a joint account holder, this adaptable calculator is perfect for anyone looking for small savings and income tax saving investments. With a minimum investment amount of just Rs. 100 and no maximum limit, NSCs are a flexible and secure way to grow your savings. Plus, with a user-friendly interface, graphical visualization of calculations, and the option to view reports yearly or monthly, this app makes managing your investments a breeze. Best of all, no internet connection is required, ensuring you can access your NSC calculations anytime, anywhere.

Features of NSC Interest Calculator:

* Maturity Amount Calculation: The app is designed to calculate the maturity amount of National Savings Certificates (NSC) invested in Post Office for a specified period. This adaptable calculator provides accurate results based on the invested amount and the interest rate.

* Small Savings and Tax Saving Investments: NSC is primarily used for small savings and income tax saving investments in India. By investing in NSC, individuals can save on their income tax liability while also earning a competitive interest rate.

* Flexible Investment Options: National Savings Certificates can be purchased from any Post Office in India by various individuals and entities. This includes adults, minors, trusts, and two adults jointly. This flexibility allows anyone to invest in NSC and benefit from its attractive interest rates.

* No Premature Withdrawals: NSCs do not allow premature withdrawals. This ensures that the investment remains intact for the specified period, providing a secure and steady source of savings and income.

Tips for Users:

* Start with the Minimum Investment: It is recommended to start with the minimum investment amount of Rs. 100. This allows individuals to get familiar with NSC and understand its benefits without committing a large sum of money.

* Consider Long-Term Investments: NSCs have a fixed maturity period, and the longer the investment period, the higher the interest rate. Consider investing for the maximum period of 5 years to maximize your earnings.

* Utilize Tax Rebate Benefits: NSC investments qualify for tax rebate under Section 80C of the Income Tax Act. Take full advantage of this benefit by investing in NSC and reducing your taxable income.

Conclusion:

The NSC Interest Calculator is an essential tool for individuals looking to invest in National Savings Certificates and plan their savings effectively. With its user-friendly interface and graphical visualization of calculations, the app makes it easy to understand and track the maturity amount over time. Whether you are a first-time investor or an experienced one, the app provides the necessary information and features to make informed investment decisions. Maximize your savings and take advantage of the tax benefits offered by NSC with this comprehensive calculator app. Download now and start planning your financial future!

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16