Danamas Lender

Version:2.0.31

Published:2024-08-13

Introduction

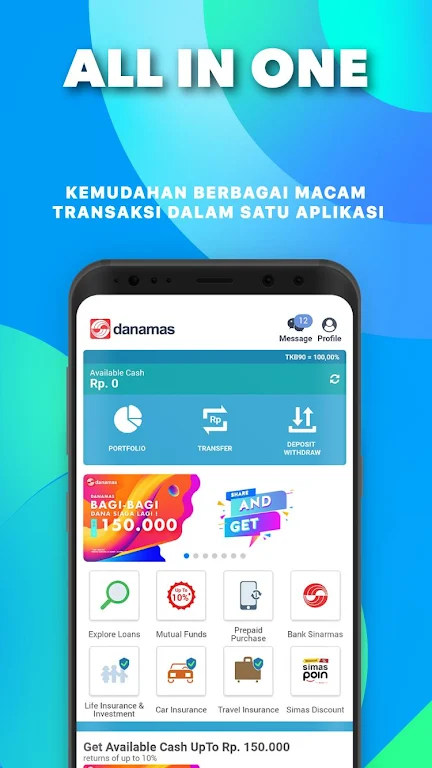

Introducing Danamas Lender, the first P2P lending platform in Indonesia that has received validation from OJK & KEMKOMINFO. As a subsidiary of PT. Sinarmas Group, it comes with a solid company profile and a great reputation in the banking world. So why should you join it as a lender? Firstly, it offers a higher return value than traditional bank deposits, making it a great alternative investment option. Secondly, the registration process is simple and can be done anytime, anywhere with just a few details. Lastly, by lending through it, you are not only earning returns but also helping local businesses thrive

Features of Danamas Lender:

⭐ SOLID COMPANY PROFILE:

Danamas Lender stands out as a reliable and trustworthy platform, validated by the OJK and trusted by the KEMKOMINFO. Being part of an organization that accommodates Fintech Peer to Peer (P2P) Lending or Online Funding Fintech entrepreneurs in Indonesia (AFPI), it ensures a secure and regulated environment for lenders.

⭐ ALTERNATIVE INVESTMENT METHOD:

If you are looking for an alternative investment with higher returns than bank deposits, it is the perfect choice for you. With competitive return rates and lower risk exposure, it offers an attractive investment opportunity for lenders seeking to diversify their portfolios.

⭐ SIMPLE REGISTRATION PROCESS:

Joining it as a lender is hassle-free and convenient. The registration process is straightforward and can be completed anytime, anywhere. All you need is your phone number, ID card, and basic profile information to get started.

⭐ HIGH RETURN RATE:

Danamas Lender provides lenders with a higher return rate compared to other investment options. With returns starting from 7% to 10% annually and a tenure period ranging from 2 to 12 months, lenders can maximize their earnings and grow their wealth.

FAQs:

⭐ How secure is it as an investment platform?

Danamas Lender is validated by the OJK and trusted by the KEMKOMINFO, ensuring a secure and regulated environment for lenders. Additionally, it has a solid company profile as a subsidiary of PT. Sinarmas Group, a reputable name in the banking world. Lenders can have confidence in the platform's reliability.

⭐ What is the minimum investment required to join it as a lender?

Danamas Lender does not have a minimum investment requirement, allowing lenders to invest according to their financial capabilities and goals. Whether you are a small or large-scale investor, it welcomes all lenders to participate.

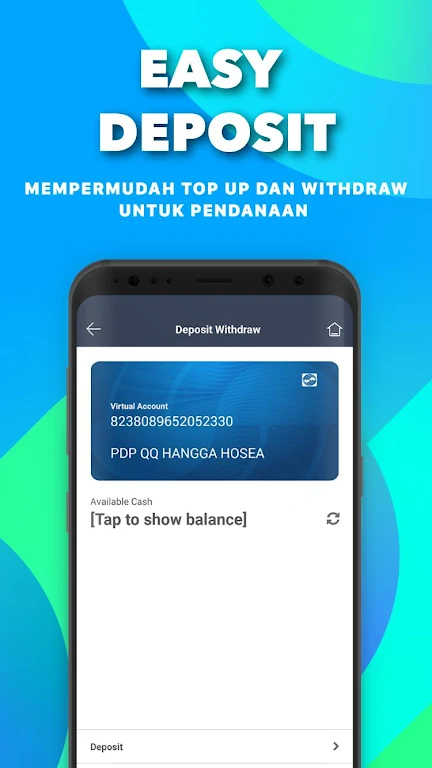

⭐ Can lenders have access to their funds before the tenure period ends?

Lenders can withdraw their funds before the tenure period ends, but they may incur certain penalties or fees. It is recommended to consult the platform's terms and conditions or contact customer support for more information regarding early withdrawals.

Conclusion:

Joining Danamas Lender as a lender offers several attractive points, including a solid company profile, higher return rates, simple registration process, and the opportunity to help local businesses. With its validation from the OJK, trust from the KEMKOMINFO, and being part of an organization that accommodates Fintech Peer to Peer (P2P) Lending or Online Funding Fintech entrepreneurs in Indonesia (AFPI), it ensures a secure and regulated environment for lenders. Moreover, it provides exclusive features such as access to Sinarmas Asset Management mutual funds and the convenient Jido Fund. Don't miss out on this opportunity to diversify your investment portfolio and grow your wealth with it.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16