LOAN CREDIT PLANNER : FINANCIAL CALCULATOR

Version:1.0

Published:2024-11-27

Introduction

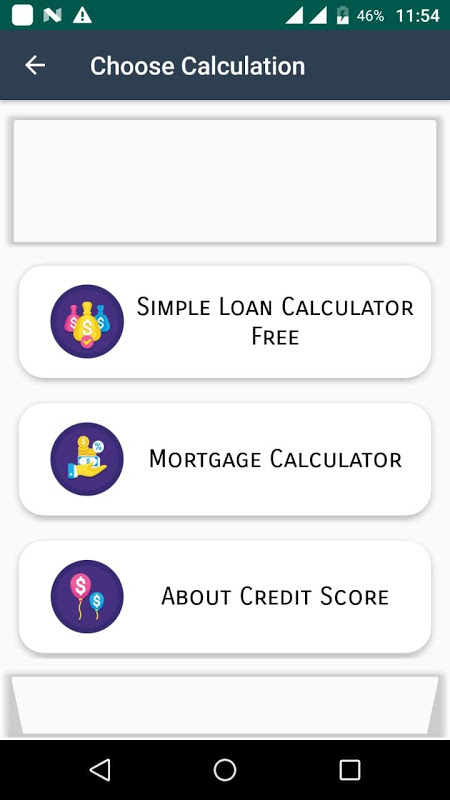

LOAN CREDIT PLANNER: FINANCIAL CALCULATOR is a powerful financial tool that is designed to make managing loans and credits a breeze. This app gives users the ability to calculate and plan their finances effectively. With its intuitive interface, it allows you to input all the necessary information such as loan amount, interest rate, and repayment term. The app then promptly generates accurate calculations, including monthly payments and total interest. What sets this app apart is its planning feature, which enables users to compare various loan scenarios side by side. With the app, making informed financial decisions has never been easier.

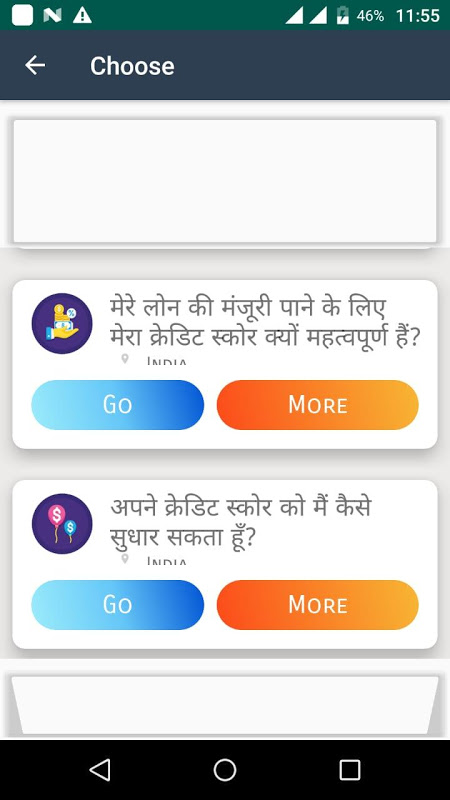

Features of LOAN CREDIT PLANNER: FINANCIAL CALCULATOR:

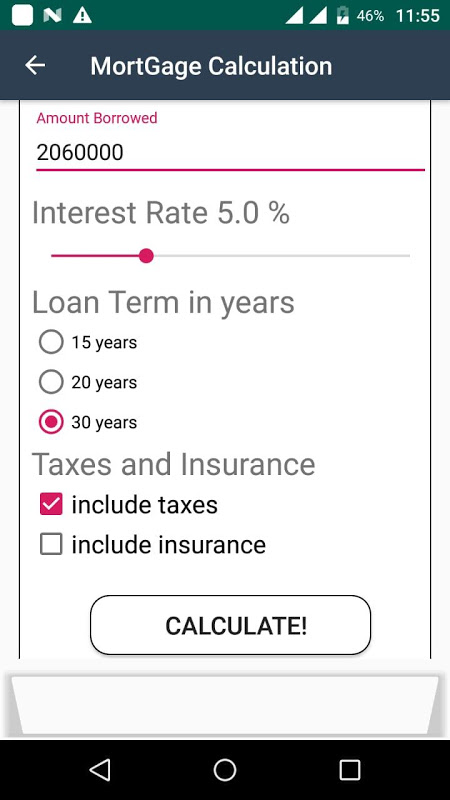

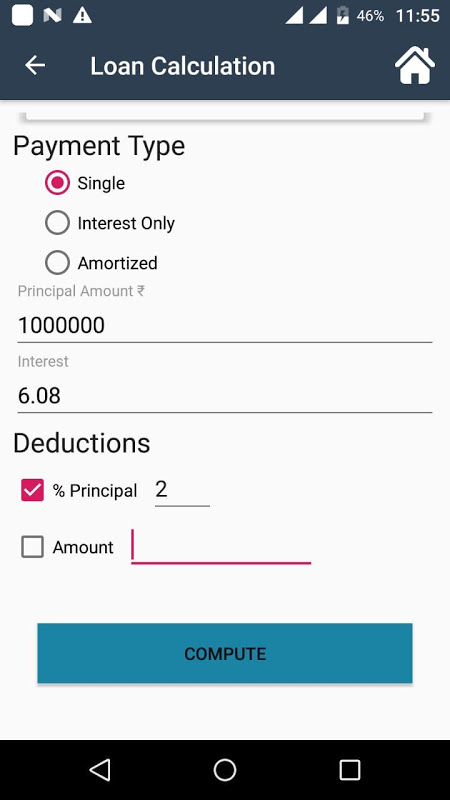

* Loan Calculation:

With the app, you can easily calculate your loan amount, interest rate, and repayment term. Whether you're planning to get a personal loan or a mortgage, this feature will provide you with accurate calculations so you can make informed financial decisions.

* Amortization Schedule:

Managing your loan payments has never been easier. The app generates a detailed amortization schedule, showing you exactly how much of your payment goes towards the principal and interest each month. This helps you track your progress and plan your budget accordingly.

* Debt Consolidation:

Are you burdened with multiple loans and credit card debts? The app's debt consolidation feature helps you simplify your finances by merging all your debts into a single loan. You can then calculate the new repayment terms and potential savings, making it easier to manage and pay off your debt.

* Comparison Tool:

Choosing the right loan option can be overwhelming with so many choices available. However, the app's comparison tool simplifies this task by allowing you to compare different loan offers side by side. This feature helps you effortlessly weigh the pros and cons, ensuring that you choose the most suitable loan option for your needs.

Tips for Users:

* Explore Different Loan Scenarios:

Take advantage of the app's loan calculation feature to explore different loan scenarios. Change the loan amount, interest rate, and repayment term to see how it affects your monthly payments and total interest paid. This will give you a clear understanding of the financial implications of different loan options.

* Create a Repayment Strategy:

Use the app's amortization schedule to create a repayment strategy. Identify the optimal repayment term and monthly payment that aligns with your budget and financial goals. This will help you stay on track and pay off your loan efficiently.

* Utilize the Debt Consolidation Feature:

If you have multiple loans and credit card debts, consider using the app's debt consolidation feature. It not only simplifies your finances but also helps you save on interest payments. Calculate the potential savings and repayment terms to determine if debt consolidation is the right option for you.

Conclusion:

LOAN CREDIT PLANNER: FINANCIAL CALCULATOR is a comprehensive financial calculator app that empowers users to make informed and strategic decisions when it comes to loans and debt management. With its accurate loan calculations, detailed amortization schedule, debt consolidation feature, and comparison tool, users can confidently navigate through various loan options and determine the most suitable solution for their financial needs. Take control of your finances and download the app today to make smarter loan decisions and achieve your financial goals.

Show More

Information

Screenshots

Latest Update

Hot Tags

Latest News

-

-

-

PUBG Mobile Teams Up with Bentley Motors: Luxury Cars, Exclusive Collectibles, and Beyond 2024-04-18

-

-

V2.2 of the Farlight 84 update introduces an overhauled Season structure, fresh in-game currency, an 2024-04-16

-

-

April 2024 Clash of Clans Update: Unveiling a Fresh Companion, Enhanced Levels, Chat Tagging, and Be 2024-04-16